| URBAN AIR MOBILITY |

| Additional Information and Where to Find It Experience Investment Corp.(“EIC”) has filed with the U.S. Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 (the “Form S-4”), which includes a preliminary proxy statement/prospectus in connection with the proposed business combination (the “Merger”) and will mail a definitive proxy statement/prospectus and other relevant documents to its stockholders. EIC’s stockholders and other interested persons are advised to read the preliminary proxy statement/prospectus, and amendments thereto, and the definitive proxy statement/prospectus in connection with EIC’s solicitation of proxies for its stockholders’ meeting to be held to approve the Merger because the proxy statement/prospectus will contain important information about EIC, Blade and the Merger. The definitive proxy statement/prospectus will be mailed to stockholders of EIC as of a record date to be established for voting on the Merger. Stockholders will also be able to obtain copies of the Registration Statement on Form S-4 and the proxy statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov or by directing a request to Experience Investment Corp., 100 St. Paul St., Suite 800. Denver, CO 80206 or mrichardson@riverinc.com. Participants in the Solicitation EIC, Blade and certain of their respective directors and officers may be deemed participants in the solicitation of proxies of EIC’s stockholders with respect to the approval of the Merger. EIC and Blade urge investors, stockholders and other interested persons to read, when available, the Form S-4, including the preliminary proxy statement/prospectus and amendments thereto and the definitive proxy statement/prospectus and documents incorporated by reference therein, as well as other documents filed with the SEC in connection with the Merger, as these materials will contain important information about Blade, EIC and the Merger. Information regarding EIC’s directors and officers and a description of their interests in EIC is contained in EIC’s annual report on Form 10-K for the fiscal year ended December 31, 2020. Additional information regarding the participants in the proxy solicitation, including Blade’s directors and officers, and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Registration Statement on Form S-4 and the definitive proxy statement/prospectus for the Merger when available. Each of these documents is, or will be, available at the SEC’s website or by directing a request to EIC as described above under “Additional Information About the Transaction and Where to Find It.” Non-GAAP financial measures This presentation includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”), including, but not limited to Adjusted EBITDA and other metrics derived therefrom. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s or Blade’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. In addition, historical financial measures included in this presentation have not been audited and are subject to review and adjustment accordingly. You should be aware that the Company’s and Blade’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. No Offer or Solicitation This presentation is not a proxy statement or solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the Transactions and shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. 2 |

| Forward Looking Statements This presentation contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “could”, “continue”, “expect”, “estimate”, “may”, “plan”, “outlook”, “future” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements, which involve risks and uncertainties, relate to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable and may also relate to EIC’s and Blade’s future prospects, developments and business strategies. In particular, such forward-looking statements include statements concerning the timing of the Merger, the business plans, objectives, expectations and intentions of EIC once the Merger and the other transactions contemplated thereby (the “Transactions”) and change of name are complete (“New Blade”), and Blade’s estimated and future results of operations, business strategies, competitive position, industry environment and potential growth opportunities. These statements are based on EIC’s or Blade’s management’s current expectations and beliefs, as well as a number of assumptions concerning future events. Such forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside EIC’s or Blade’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors include, but are not limited to:(1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement;(2) the inability to complete the Transactions due to the failure to obtain approval of the stockholders of EIC or Blade or other conditions to closing in the Merger Agreement;(3) the ability of New Blade to meet Nasdaq’s listing standards (or the standards of any other securities exchange on which securities of the public entity are listed) following the Merger;(4) the inability to complete the private placement of common stock of EIC to certain institutional accredited investors;(5) the risk that the announcement and consummation of the Transactions disrupts Blade’s current plans and operations;(6) the ability to recognize the anticipated benefits of the Transactions, which may be affected by, among other things, competition, the ability of New Blade to grow and manage growth profitably, maintain relationships with customers, business partners, suppliers and agents and retain its management and key employees;(7) costs related to the Transactions;(8) changes in applicable laws or regulations and delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals required to complete the Transactions;(9) the possibility that Blade and New Blade may be adversely affected by other economic, business, regulatory and/or competitive factors;(10) the impact of COVID-19 on Blade’s and New Blade’s business and/or the ability of the parties to complete the Transactions;(11) the outcome of any legal proceedings that may be instituted against EIC, Blade, New Blade or any of their respective directors or officers, following the announcement of the Transactions; and (12) the failure to realize anticipated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions and purchase price and other adjustments. Additional factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements can be found in EIC’s most recent annual report on Form 10-K, subsequently filed quarterly reports on Form 10-Q and current reports on Form 8-K, which are available, free of charge, at the SEC’s website at www.sec.gov, and will also be provided in the Registration Statement on Form S-4 and EIC’s proxy statement/prospectus when available. New risks and uncertainties arise from time to time, and it is impossible for us to predict these events or how they may affect us. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and EIC and Blade undertake no obligation to update or revise the forward-looking statements, whether as a result of new information, changes in expectations, future events or otherwise. This presentation is not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in EIC and is not intended to form the basis of an investment decision in EIC. All subsequent written and oral forward-looking statements concerning EIC and Blade, the Transactions or other matters and attributable to EIC and Blade or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. 3 |

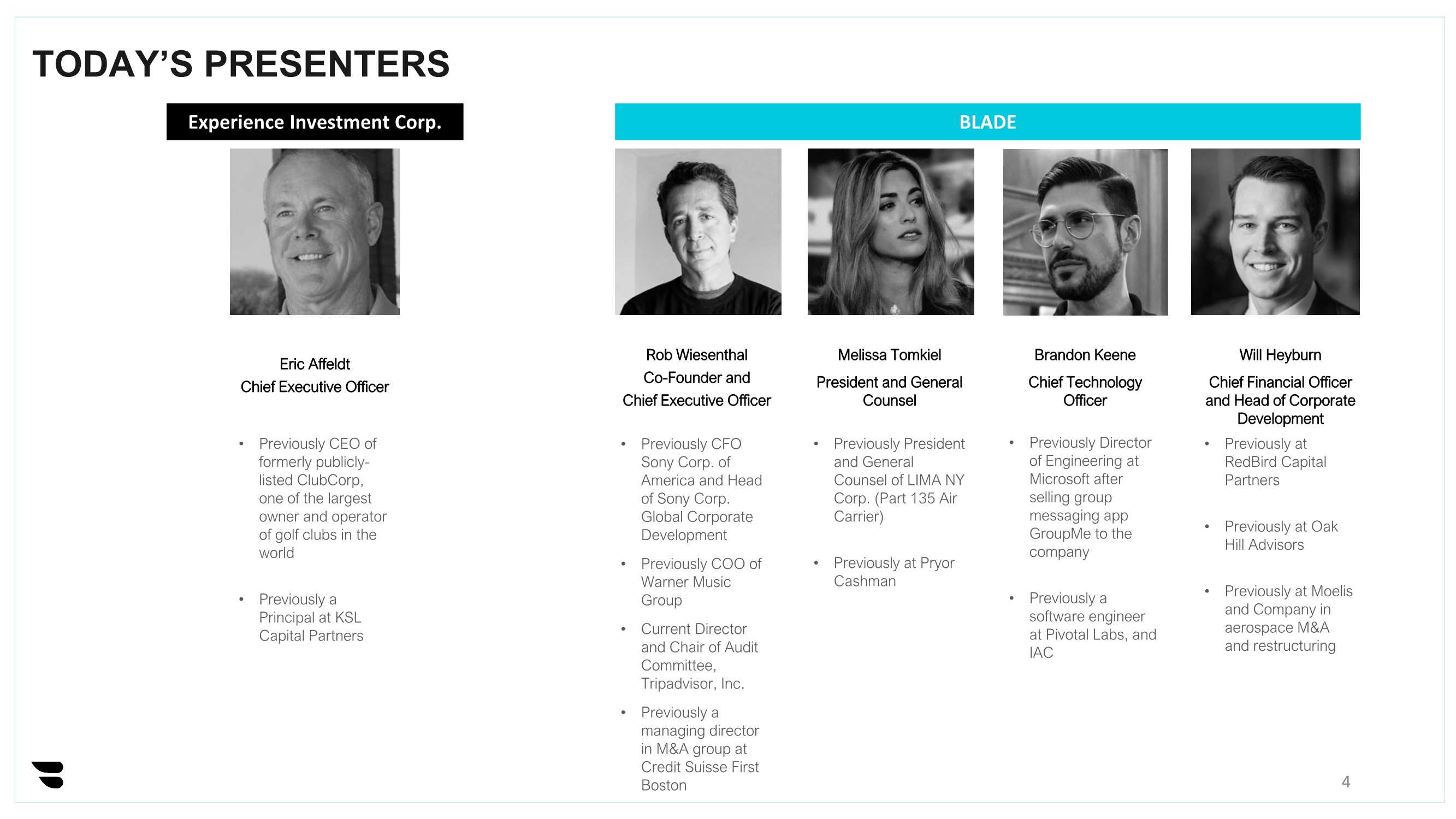

| TODAY’S PRESENTERS 4 Experience Investment Corp. Eric Affeldt Chief Executive Officer • Previously CEO of formerly publicly- listed ClubCorp, one of the largest owner and operator of golf clubs in the world • Previously a Principal at KSL Capital Partners BLADE Rob Wiesenthal Co-Founder and Chief Executive Officer • Previously CFO Sony Corp. of America and Head of Sony Corp. Global Corporate Development • Previously COO of Warner Music Group • Current Director and Chair of Audit Committee, Tripadvisor, Inc. • Previously a managing director in M&A group at Credit Suisse First Boston Melissa Tomkiel President and General Counsel • Previously President and General Counsel of LIMA NY Corp. (Part 135 Air Carrier) • Previously at Pryor Cashman Will Heyburn Chief Financial Officer and Head of Corporate Development • Previously at RedBird Capital Partners • Previously at Oak Hill Advisors • Previously at Moelis and Company in aerospace M&A and restructuring Brandon Keene Chief Technology Officer • Previously Director of Engineering at Microsoft after selling group messaging app GroupMe to the company • Previously a software engineer at Pivotal Labs, and IAC |

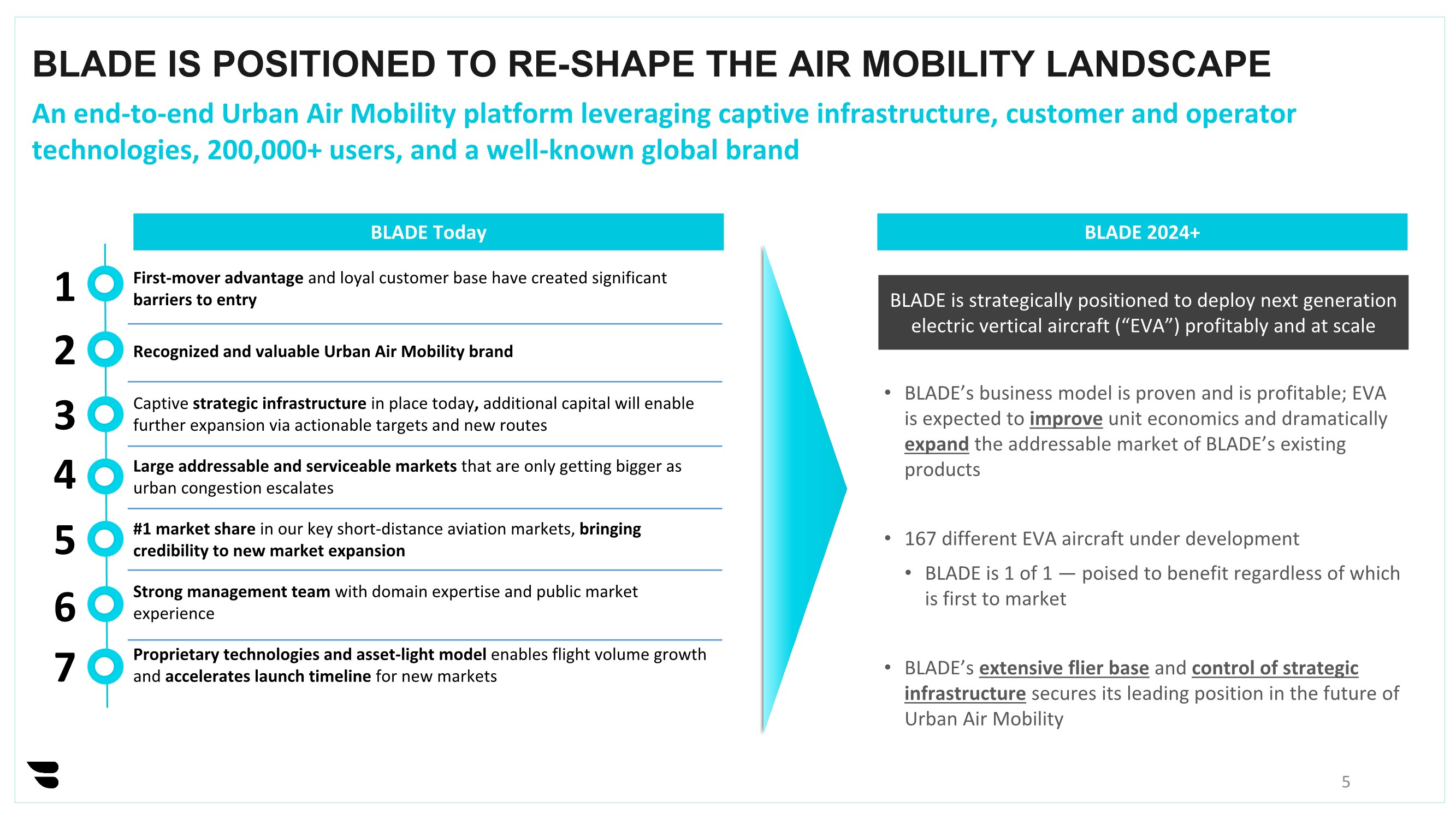

| BLADE IS POSITIONED TO RE-SHAPE THE AIR MOBILITY LANDSCAPE 5 First-mover advantage and loyal customer base have created significant barriers to entry Recognized and valuable Urban Air Mobility brand Captive strategic infrastructure in place today, additional capital will enable further expansion via actionable targets and new routes Large addressable and serviceable markets that are only getting bigger as urban congestion escalates #1 market share in our key short-distance aviation markets, bringing credibility to new market expansion Strong management team with domain expertise and public market experience Proprietary technologies and asset-light model enables flight volume growth and accelerates launch timeline for new markets BLADE Today BLADE 2024+ BLADE is strategically positioned to deploy next generation electric vertical aircraft (“EVA”) profitably and at scale • BLADE’s business model is proven and is profitable; EVA is expected to improve unit economics and dramatically expand the addressable market of BLADE’s existing products • 167 different EVA aircraft under development • BLADE is 1 of 1 — poised to benefit regardless of which is first to market • BLADE’s extensive flier base and control of strategic infrastructure secures its leading position in the future of Urban Air Mobility 1 2 3 4 5 6 7 An end-to-end Urban Air Mobility platform leveraging captive infrastructure, customer and operator technologies, 200,000+ users, and a well-known global brand |

| Through our powerful brand, user-friendly customer experience, strategic infrastructure, proprietary technology, 200,000 users, and asset lightbusiness model, we’ve built a platform which accommodates use of the current generation of aircraft, and a transition to EVA tomorrow. BLADE is a global Urban Air Mobility platform |

| GENESIS 7 Urban Air Mobility was not a consumer offering prior to BLADE • Expensive — typically, using large, inefficient helicopters • Low capacity utilization (6-8 seat helicopters) • Booking done by wire, typically requiring signed and “faxed” contracts and 12-hour notice • Public terminals with industrial décor and no integration with aviation service companies • No brands — a B2B service catering to corporate C-Suite and the extremely wealthy BLADE changed it all • BLADE’s mobile technology and data exhaust enable flier aggregation, route determination, and by-the-seat pricing using newer and smaller helicopters – Beat Uber Black Manhattan-JFK ground pricing with BLADE seat cost of $195 or $95 with flight pass • Booking up to 20 minutes prior to flight via BLADE mobile app • Network of private terminals provides a competitive advantage and an improved experience for our fliers • Six years of marketing and branding efforts turned BLADE into a verb for the markets we serve |

| STRATEGY 8 Grow our Urban Air Mobility platform by leveraging our: • Network of private terminals • Customer-to-cockpit technology stack • Over 200,000 users and approximately 40,000 annual fliers (2019) • Trusted brand Our proven asset-light model and growing flier base will ensure an orderly and flexible transition from conventional rotorcraft to EVA and will support the acquisition of aircraft by our operator partners when the right equipment is available and certified. Until then, we will keep building our platform and expanding our market reach. |

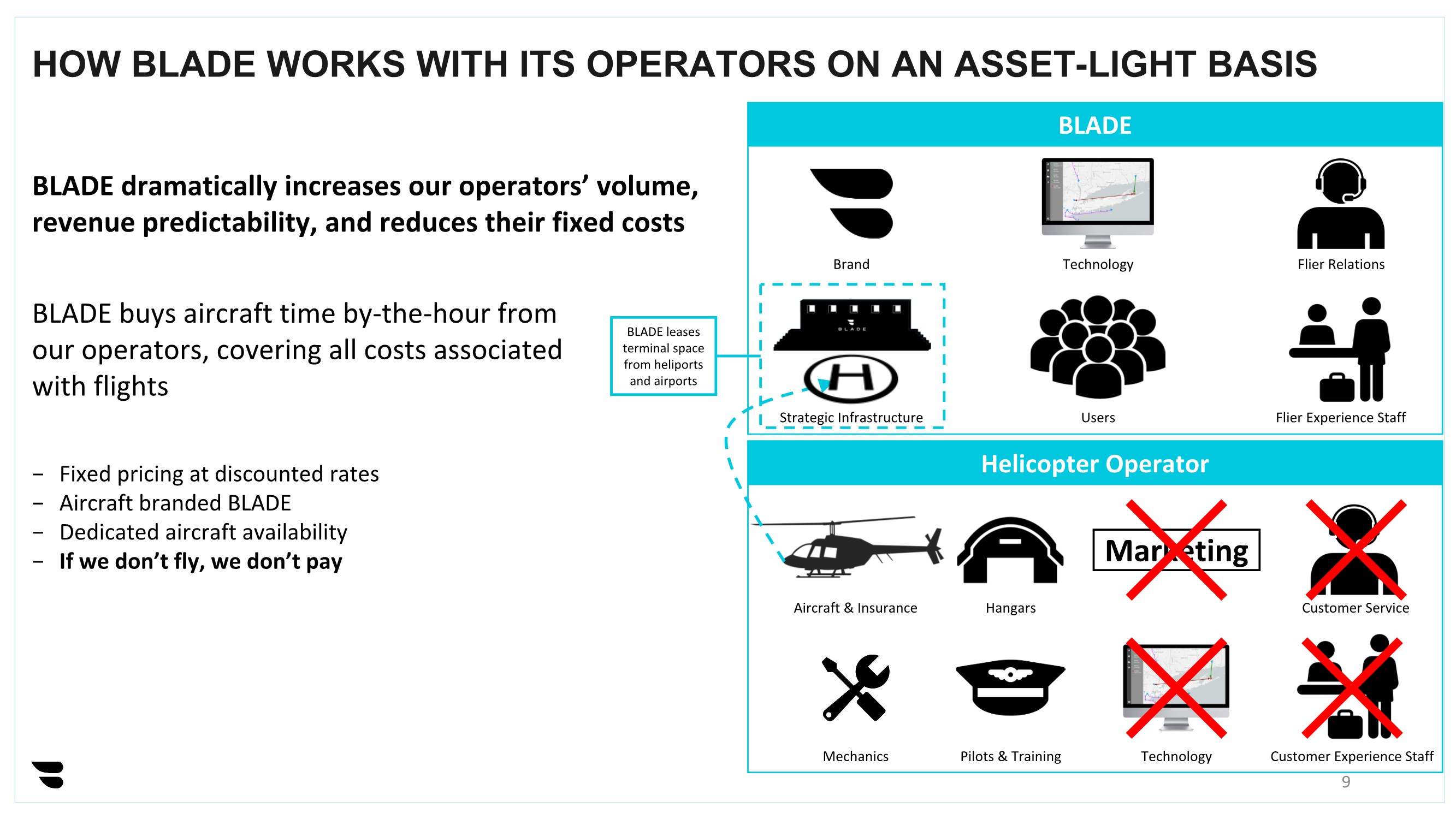

| Customer Experience Staff HOW BLADE WORKS WITH ITS OPERATORS ON AN ASSET-LIGHT BASIS BLADE Brand Technology Helicopter Operator Pilots & Training Mechanics Hangars Aircraft & Insurance Customer Service Marketing Technology Users Strategic Infrastructure Flier Experience Staff BLADE leases terminal space from heliports and airports Flier Relations BLADE dramatically increases our operators’ volume, revenue predictability, and reduces their fixed costs − Fixed pricing at discounted rates − Aircraft branded BLADE − Dedicated aircraft availability − If we don’t fly, we don’t pay 9 BLADE buys aircraft time by-the-hour from our operators, covering all costs associated with flights |

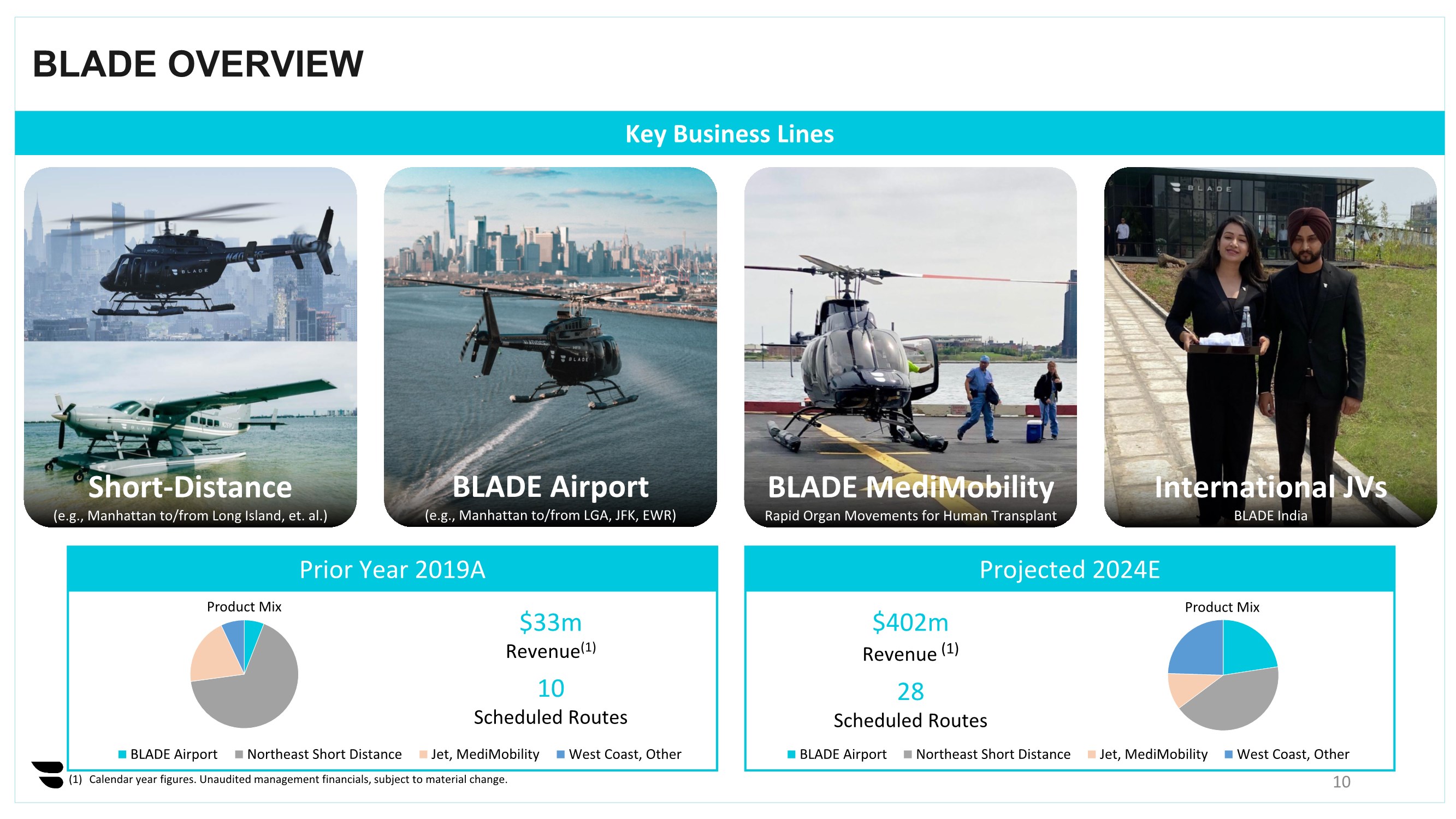

| BLADE OVERVIEW 10 Key Business Lines BLADE Airport (e.g., Manhattan to/from LGA, JFK, EWR) Short-Distance (e.g., Manhattan to/from Long Island, et. al.) BLADE MediMobility Rapid Organ Movements for Human Transplant International JVs BLADE India Prior Year 2019A Product Mix BLADE Airport Northeast Short Distance Jet, MediMobility West Coast, Other 10 Scheduled Routes $33m Revenue(1) Product Mix BLADE Airport Northeast Short Distance Jet, MediMobility West Coast, Other Projected 2024E 28 Scheduled Routes $402m Revenue (1) (1) Calendar year figures. Unaudited management financials, subject to material change. |

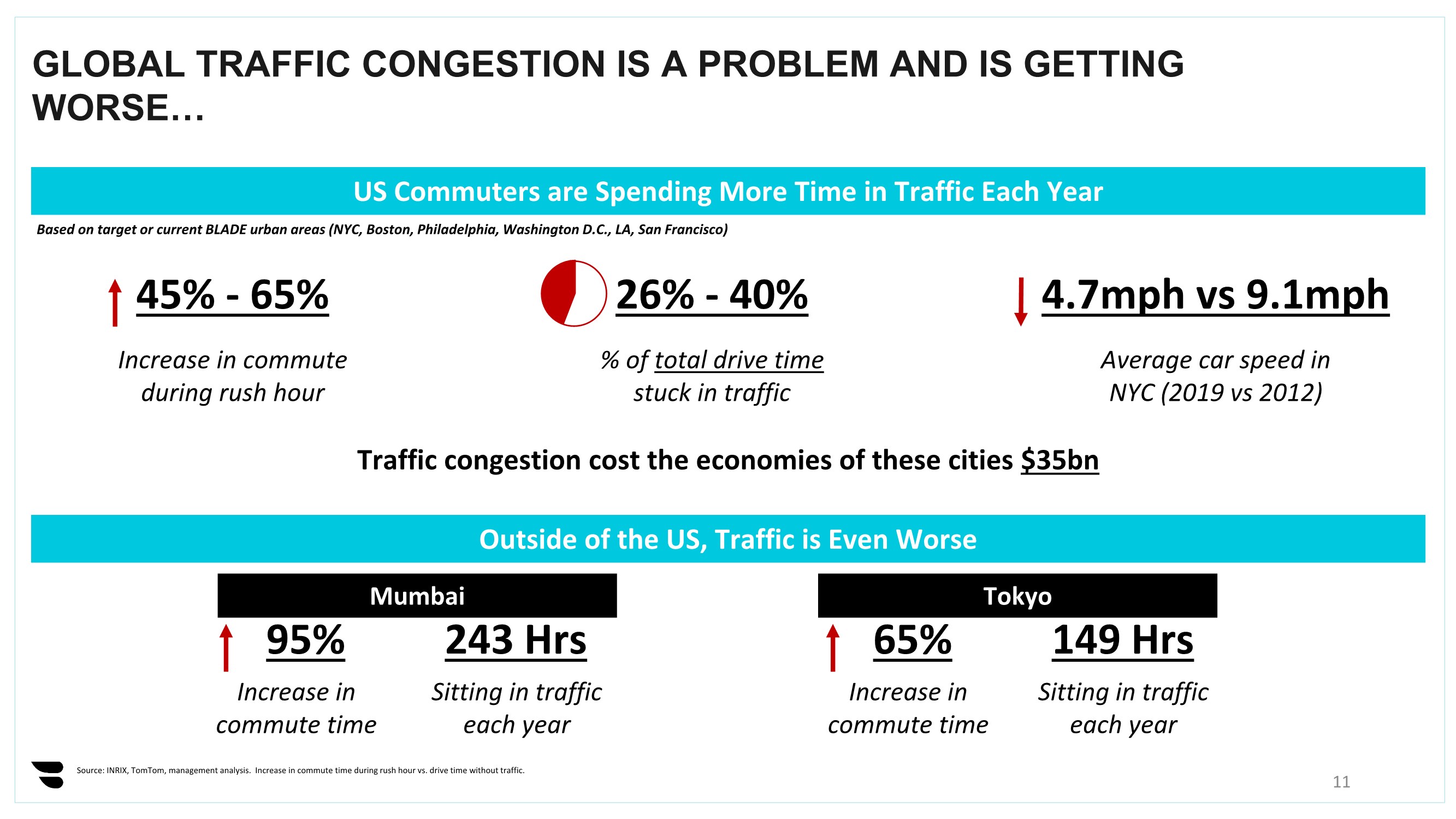

| GLOBAL TRAFFIC CONGESTION IS A PROBLEM AND IS GETTING WORSE… 11 Source: INRIX, TomTom, management analysis. Increase in commute time during rush hour vs. drive time without traffic. US Commuters are Spending More Time in Traffic Each Year Outside of the US, Traffic is Even Worse Based on target or current BLADE urban areas (NYC, Boston, Philadelphia, Washington D.C., LA, San Francisco) Traffic congestion cost the economies of these cities $35bn 45% - 65% Increase in commute during rush hour 26% - 40% % of total drive time stuck in traffic 4.7mph vs 9.1mph Average car speed in NYC (2019 vs 2012) 95% Increase in commute time Mumbai Tokyo 243 Hrs Sitting in traffic each year 65% Increase in commute time 149 Hrs Sitting in traffic each year |

| BLADE SOLVES THIS PROBLEM |

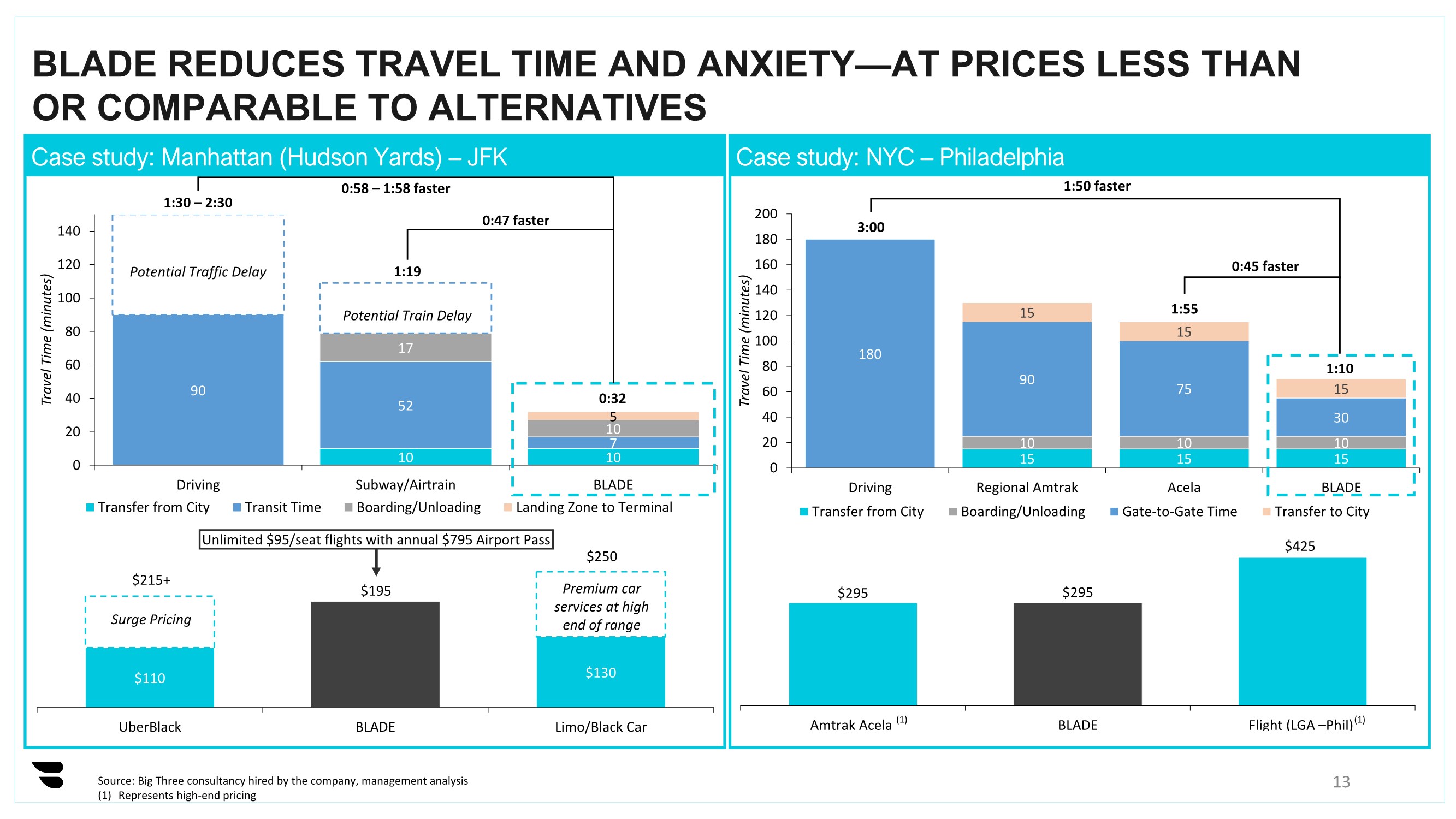

| 15 15 15 10 10 10 180 90 75 30 15 15 15 0 20 40 60 80 100 120 140 160 180 200 Driving Regional Amtrak Acela BLADE Travel Time (minutes) Transfer from City Boarding/Unloading Gate-to-Gate Time Transfer to City 10 10 90 52 7 17 10 5 0 20 40 60 80 100 120 140 Driving Subway/Airtrain BLADE Travel Time (minutes) Transfer from City Transit Time Boarding/Unloading Landing Zone to Terminal Potential Traffic Delay BLADE REDUCES TRAVEL TIME AND ANXIETY—AT PRICES LESS THAN OR COMPARABLE TO ALTERNATIVES 13 Case study: Manhattan (Hudson Yards) – JFK Case study: NYC – Philadelphia (1) 0:58 – 1:58 faster Source: Big Three consultancy hired by the company, management analysis (1) Represents high-end pricing 1:30 – 2:30 0:32 1:19 0:47 faster 1:10 1:55 3:00 1:50 faster 0:45 faster Potential Train Delay $110 $130 UberBlack BLADE Limo/Black Car Surge Pricing Premium car services at high end of range $295 $295 $425 Amtrak Acela BLADE Flight (LGA –Phil) (1) (1) $215+ $250 $195 13 Unlimited $95/seat flights with annual $795 Airport Pass |

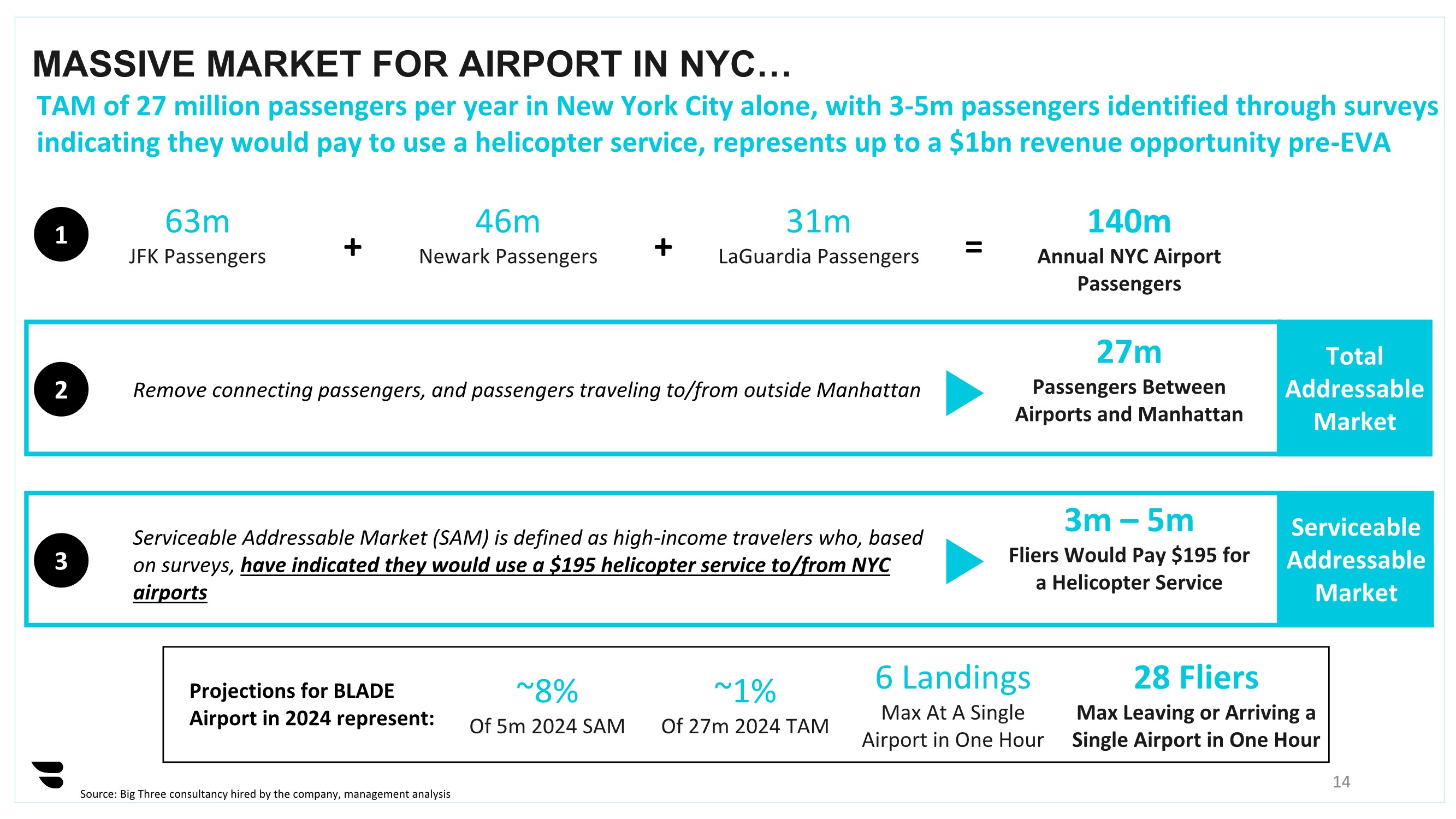

| MASSIVE MARKET FOR AIRPORT IN NYC… 14 Source: Big Three consultancy hired by the company, management analysis 63m JFK Passengers 46m Newark Passengers 31m LaGuardia Passengers 140m Annual NYC Airport Passengers + = + 27m Passengers Between Airports and Manhattan Remove connecting passengers, and passengers traveling to/from outside Manhattan 1 2 3 3m – 5m Fliers Would Pay $195 for a Helicopter Service Serviceable Addressable Market (SAM) is defined as high-income travelers who, based on surveys, have indicated they would use a $195 helicopter service to/from NYC airports TAM of 27 million passengers per year in New York City alone, with 3-5m passengers identified through surveys indicating they would pay to use a helicopter service, represents up to a $1bn revenue opportunity pre-EVA Total Addressable Market Serviceable Addressable Market ~8% Of 5m 2024 SAM Projections for BLADE Airport in 2024 represent: 6 Landings Max At A Single Airport in One Hour ~1% Of 27m 2024 TAM 28 Fliers Max Leaving or Arriving a Single Airport in One Hour |

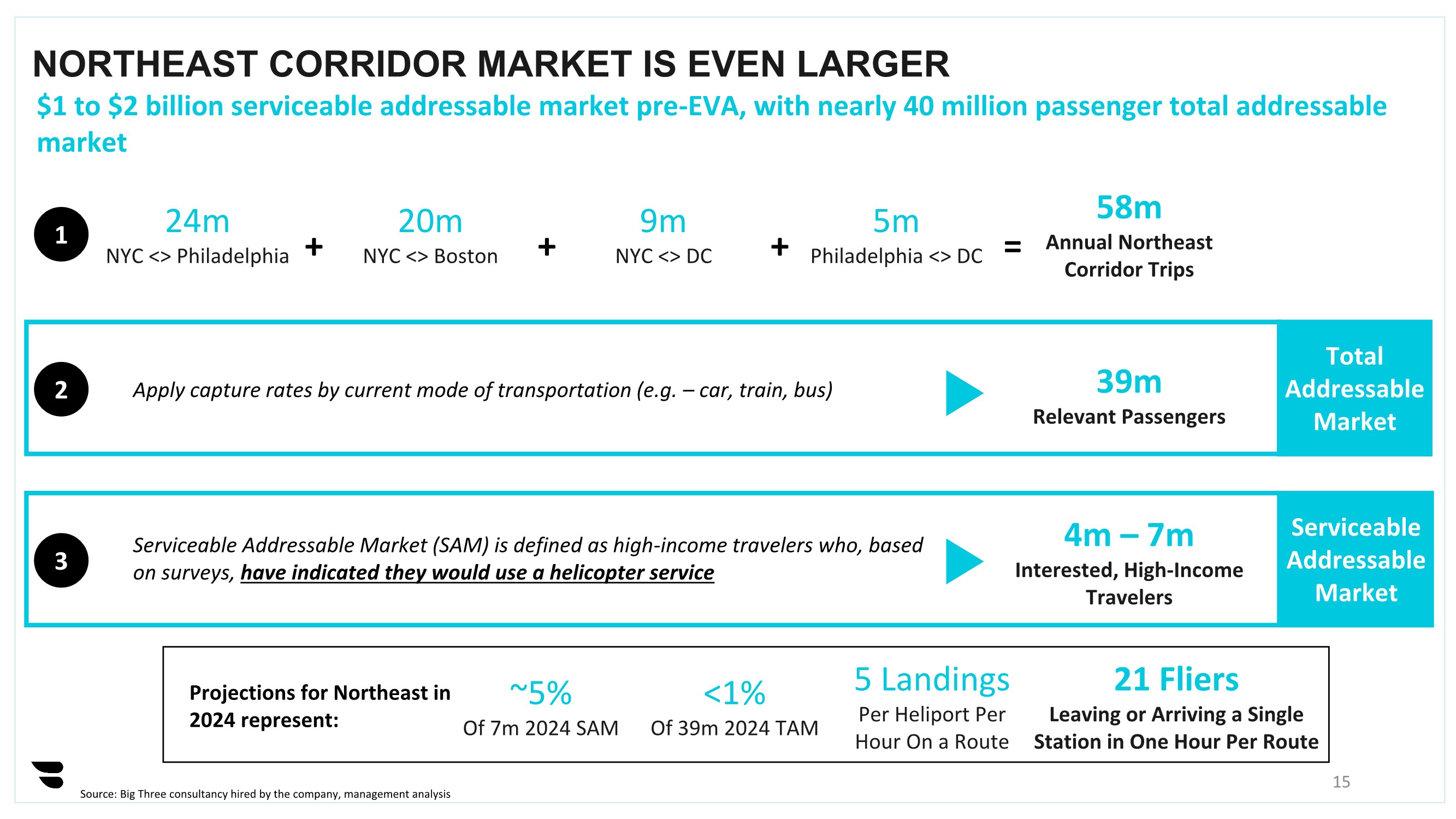

| NORTHEAST CORRIDOR MARKET IS EVEN LARGER 15 24m NYC <> Philadelphia 20m NYC <> Boston 9m NYC <> DC 58m Annual Northeast Corridor Trips + = + 39m Relevant Passengers Apply capture rates by current mode of transportation (e.g. – car, train, bus) 1 2 3 4m – 7m Interested, High-Income Travelers $1 to $2 billion serviceable addressable market pre-EVA, with nearly 40 million passenger total addressable market Total Addressable Market Serviceable Addressable Market 5m Philadelphia <> DC + Serviceable Addressable Market (SAM) is defined as high-income travelers who, based on surveys, have indicated they would use a helicopter service Source: Big Three consultancy hired by the company, management analysis ~5% Of 7m 2024 SAM <1% Of 39m 2024 TAM Projections for Northeast in 2024 represent: 5 Landings Per Heliport Per Hour On a Route 21 Fliers Leaving or Arriving a Single Station in One Hour Per Route |

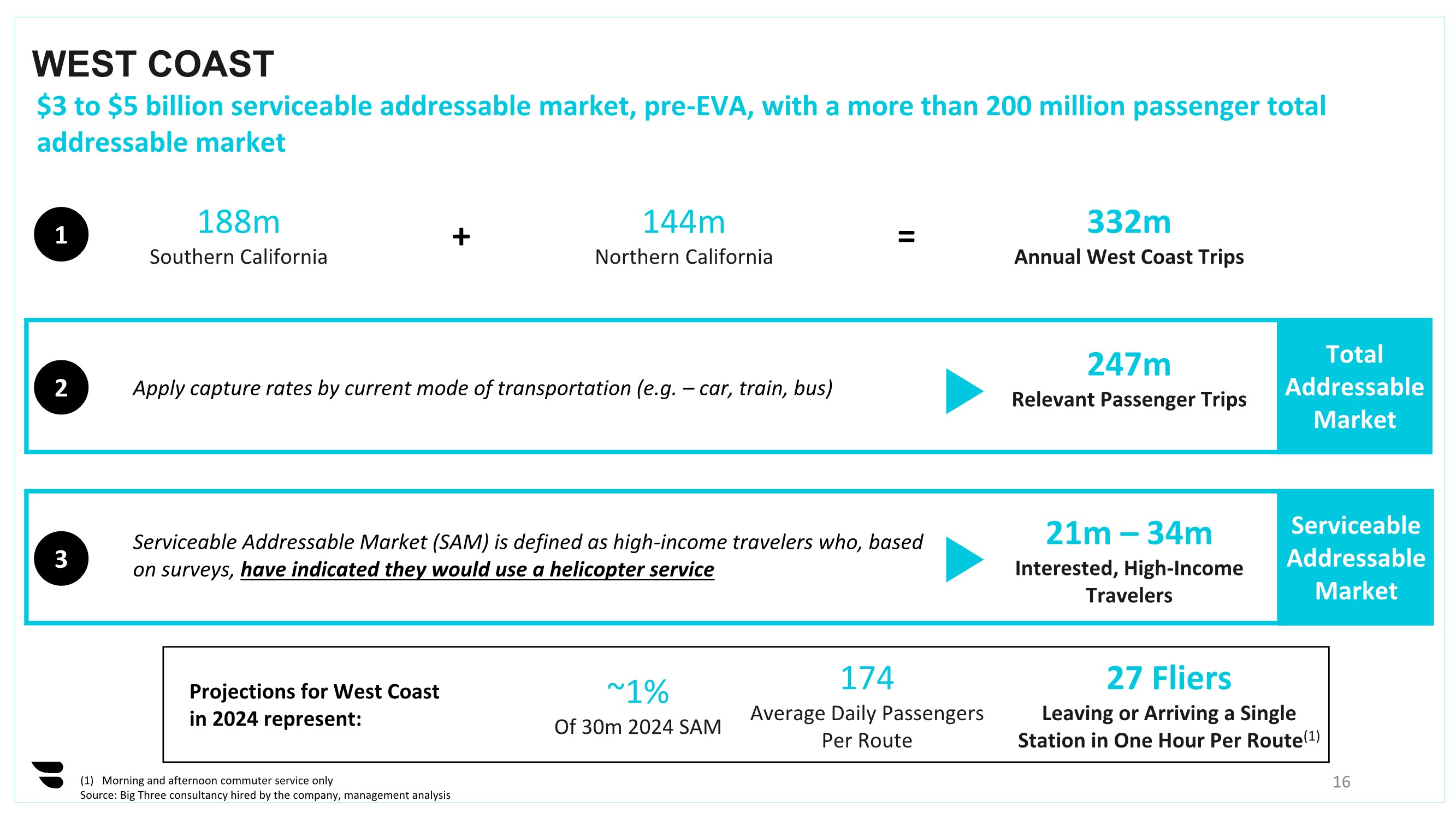

| WEST COAST 16 188m Southern California 144m Northern California 332m Annual West Coast Trips + = 247m Relevant Passenger Trips Apply capture rates by current mode of transportation (e.g. – car, train, bus) 1 2 3 21m – 34m Interested, High-Income Travelers $3 to $5 billion serviceable addressable market, pre-EVA, with a more than 200 million passenger total addressable market Total Addressable Market Serviceable Addressable Market ~1% Of 30m 2024 SAM 174 Average Daily Passengers Per Route Serviceable Addressable Market (SAM) is defined as high-income travelers who, based on surveys, have indicated they would use a helicopter service (1) Morning and afternoon commuter service only Source: Big Three consultancy hired by the company, management analysis Projections for West Coast in 2024 represent: 27 Fliers Leaving or Arriving a Single Station in One Hour Per Route(1) |

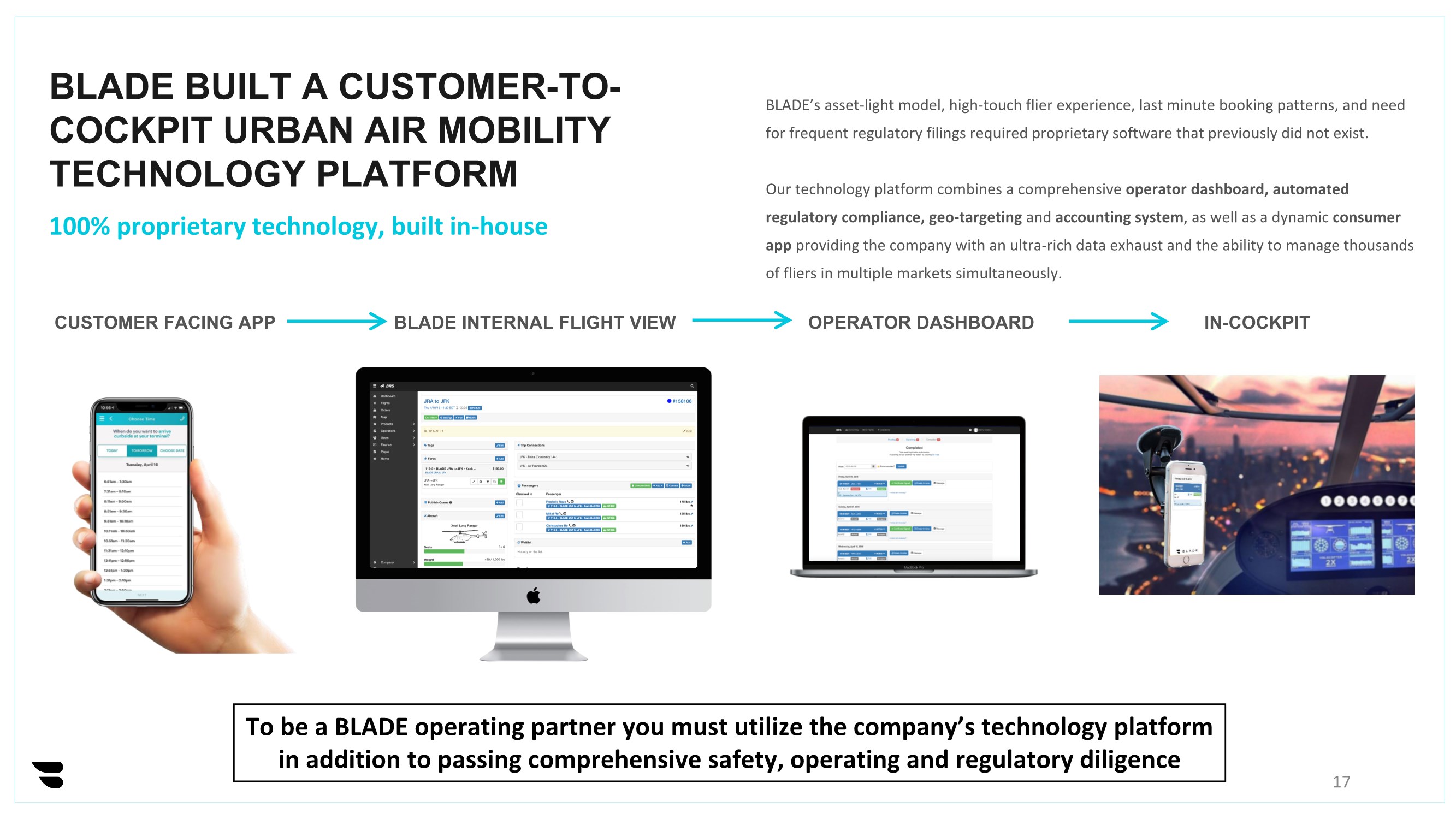

| CUSTOMER FACING APP BLADE BUILT A CUSTOMER-TO- COCKPIT URBAN AIR MOBILITY TECHNOLOGY PLATFORM BLADE’s asset-light model, high-touch flier experience, last minute booking patterns, and need for frequent regulatory filings required proprietary software that previously did not exist. Our technology platform combines a comprehensive operator dashboard, automated regulatory compliance, geo-targeting and accounting system, as well as a dynamic consumer app providing the company with an ultra-rich data exhaust and the ability to manage thousands of fliers in multiple markets simultaneously. BLADE INTERNAL FLIGHT VIEW OPERATOR DASHBOARD IN-COCKPIT 17 To be a BLADE operating partner you must utilize the company’s technology platform in addition to passing comprehensive safety, operating and regulatory diligence 100% proprietary technology, built in-house |

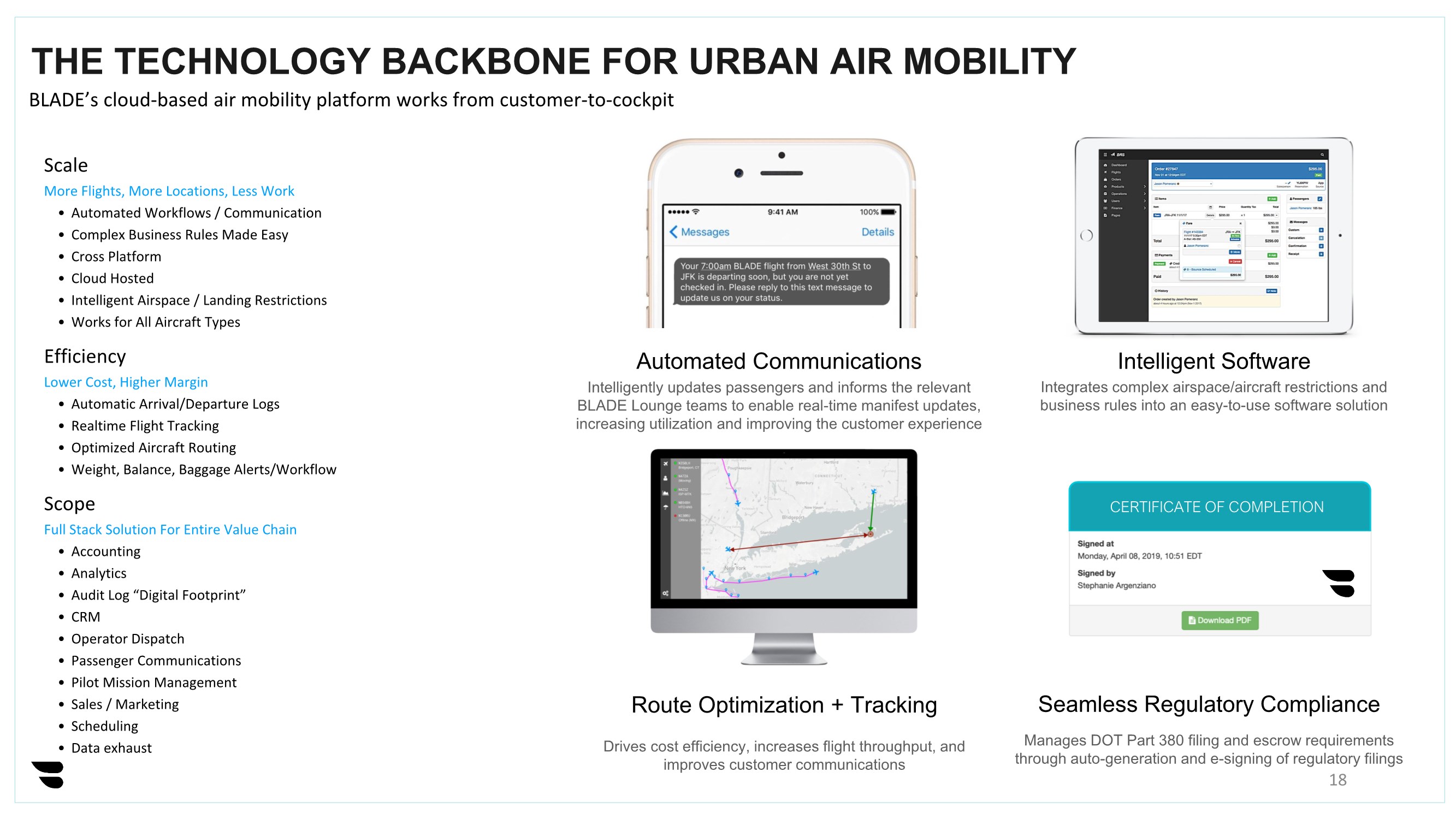

| THE TECHNOLOGY BACKBONE FOR URBAN AIR MOBILITY Seamless Regulatory Compliance Automated Communications Route Optimization + Tracking BLADE’s cloud-based air mobility platform works from customer-to-cockpit Intelligently updates passengers and informs the relevant BLADE Lounge teams to enable real-time manifest updates, increasing utilization and improving the customer experience Drives cost efficiency, increases flight throughput, and improves customer communications Manages DOT Part 380 filing and escrow requirements through auto-generation and e-signing of regulatory filings Scale More Flights, More Locations, Less Work • Automated Workflows / Communication • Complex Business Rules Made Easy • Cross Platform • Cloud Hosted • Intelligent Airspace / Landing Restrictions • Works for All Aircraft Types Efficiency Lower Cost, Higher Margin • Automatic Arrival/Departure Logs • Realtime Flight Tracking • Optimized Aircraft Routing • Weight, Balance, Baggage Alerts/Workflow Scope Full Stack Solution For Entire Value Chain • Accounting • Analytics • Audit Log “Digital Footprint” • CRM • Operator Dispatch • Passenger Communications • Pilot Mission Management • Sales / Marketing • Scheduling • Data exhaust CERTIFICATE OF COMPLETION Intelligent Software Integrates complex airspace/aircraft restrictions and business rules into an easy-to-use software solution 18 |

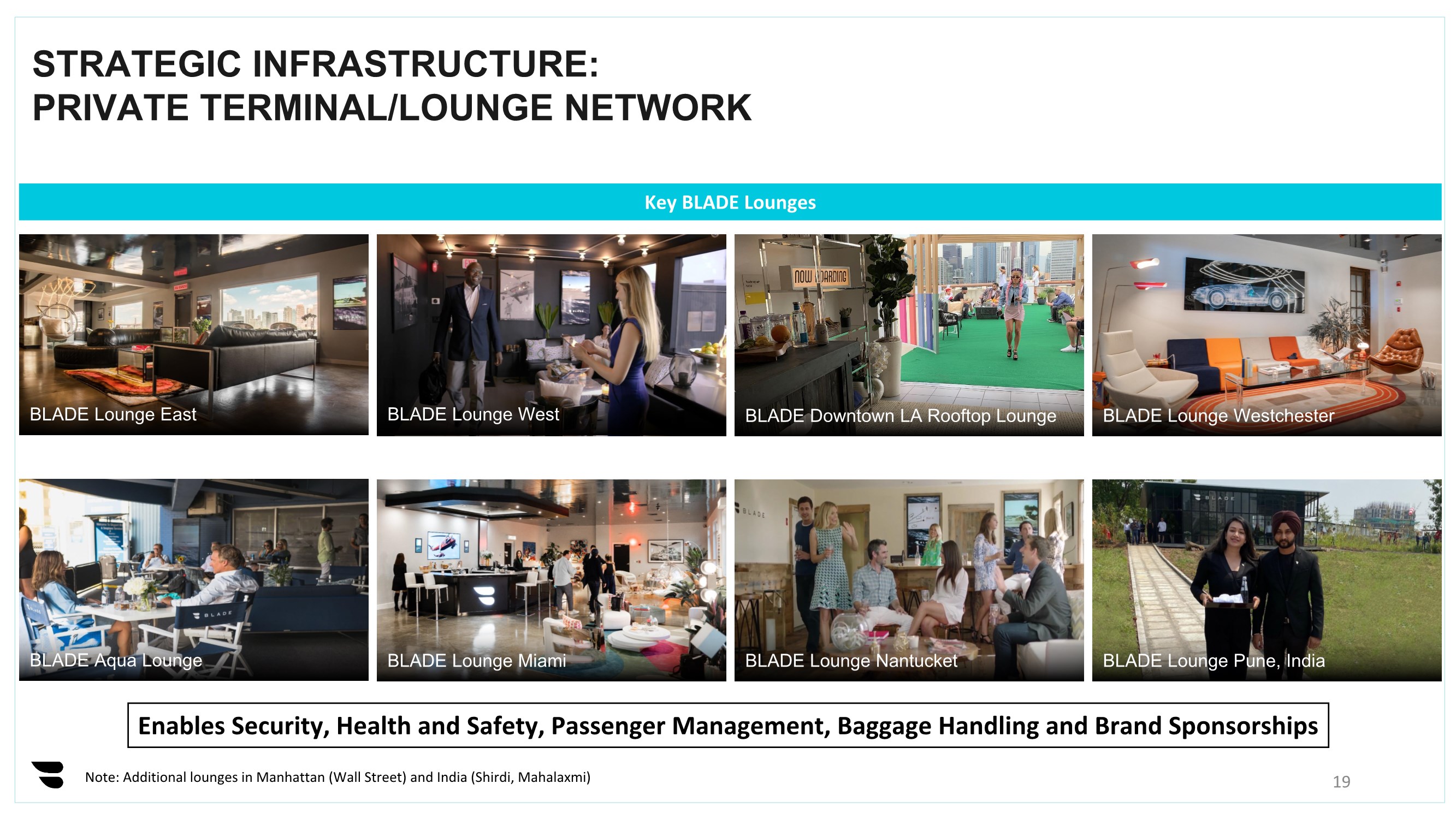

| BLADE Lounge East BLADE Aqua Lounge BLADE Lounge Miami BLADE Lounge Nantucket BLADE Downtown LA Rooftop Lounge BLADE Lounge West STRATEGIC INFRASTRUCTURE: PRIVATE TERMINAL/LOUNGE NETWORK BLADE Lounge Westchester BLADE Lounge Pune, India 19 Key BLADE Lounges Note: Additional lounges in Manhattan (Wall Street) and India (Shirdi, Mahalaxmi) Enables Security, Health and Safety, Passenger Management, Baggage Handling and Brand Sponsorships |

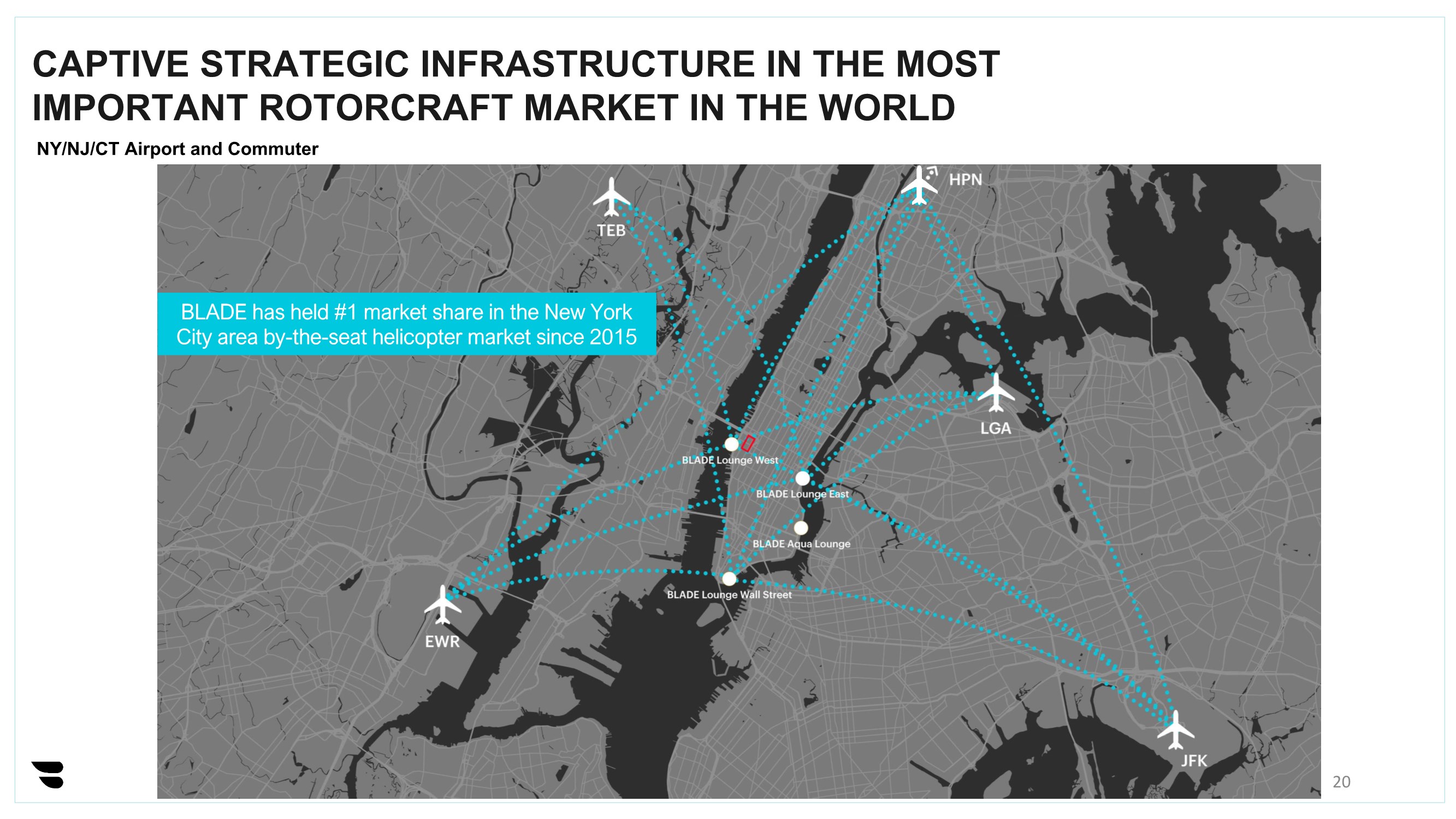

| 20 CAPTIVE STRATEGIC INFRASTRUCTURE IN THE MOST IMPORTANT ROTORCRAFT MARKET IN THE WORLD BLADE has held #1 market share in the New York City area by-the-seat helicopter market since 2015 NY/NJ/CT Airport and Commuter |

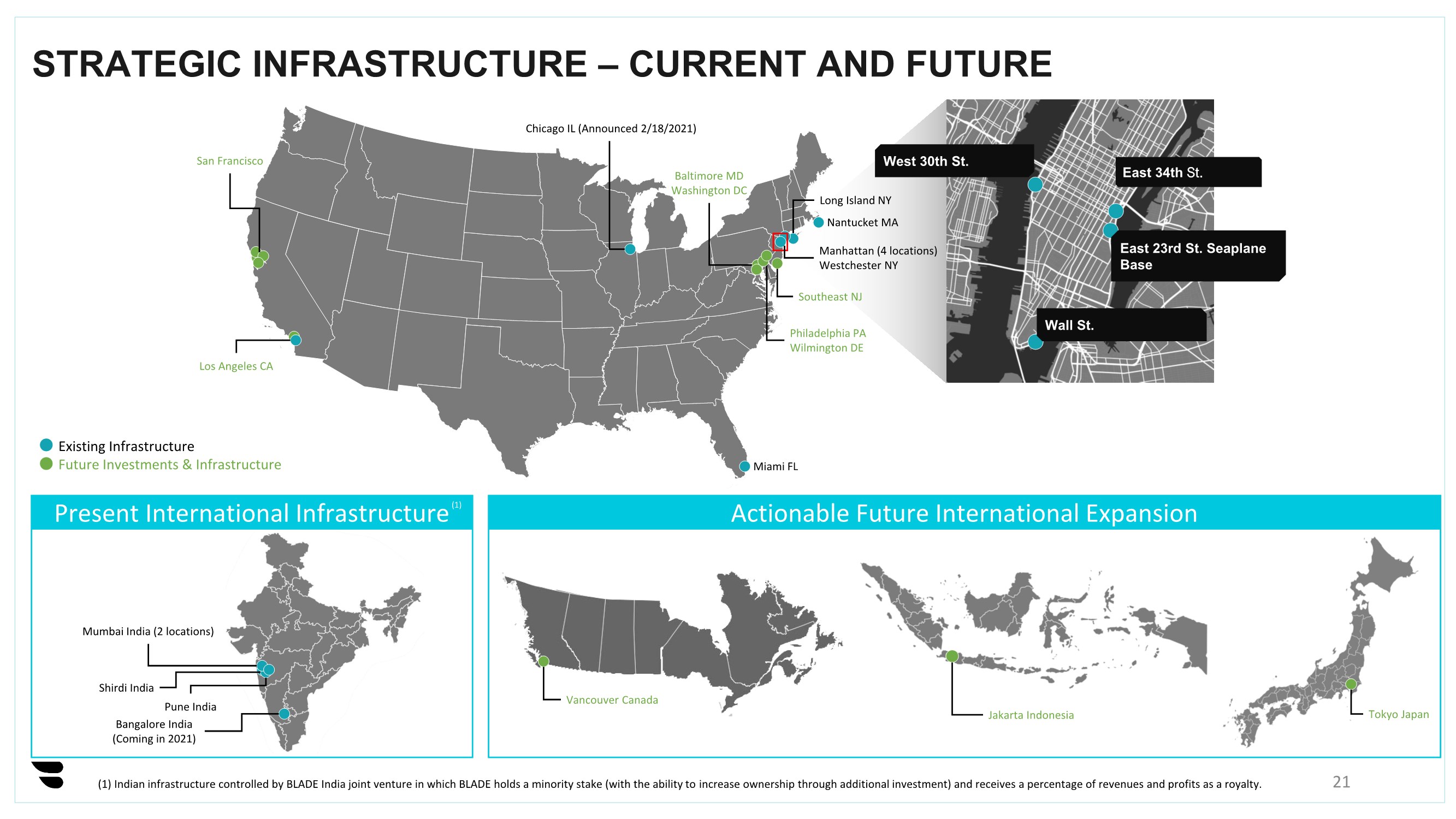

| 21 STRATEGIC INFRASTRUCTURE – CURRENT AND FUTURE Existing Infrastructure Future Investments & Infrastructure Miami FL Manhattan (4 locations) Westchester NY Philadelphia PA Wilmington DE Southeast NJ Long Island NY Nantucket MA Wall St. East 23rd St. Seaplane Base East 34th St. West 30th St. San Francisco Los Angeles CA Baltimore MD Washington DC Vancouver Canada Jakarta Indonesia Tokyo Japan Actionable Future International Expansion Mumbai India (2 locations) Pune India Shirdi India Present International Infrastructure (1) Indian infrastructure controlled by BLADE India joint venture in which BLADE holds a minority stake (with the ability to increase ownership through additional investment) and receives a percentage of revenues and profits as a royalty. (1) Chicago IL (Announced 2/18/2021) Bangalore India (Coming in 2021) |

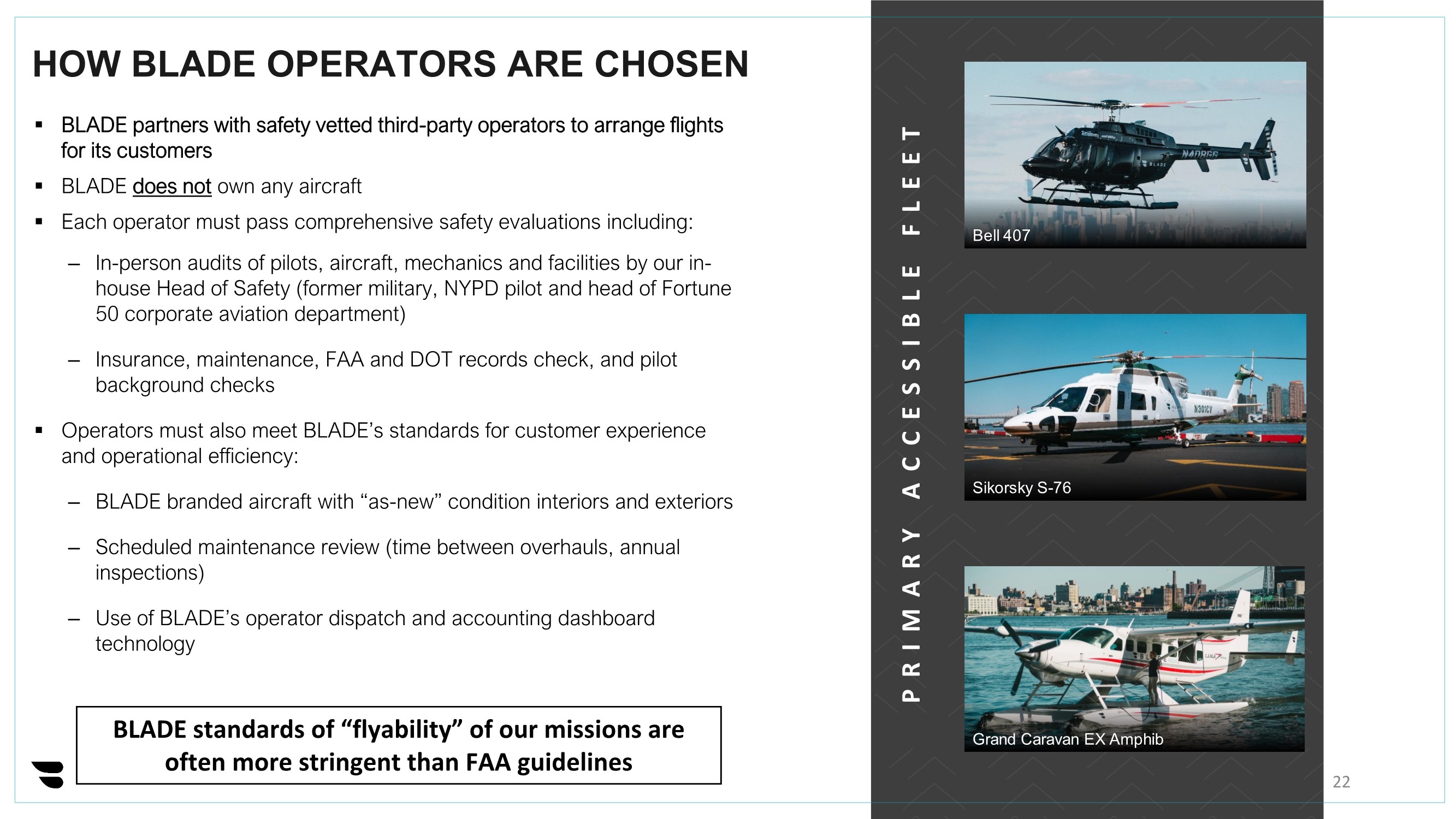

| HOW BLADE OPERATORS ARE CHOSEN Sikorsky S-76 Bell 407 Grand Caravan EX Amphib ▪ BLADE partners with safety vetted third-party operators to arrange flights for its customers ▪ BLADE does not own any aircraft ▪ Each operator must pass comprehensive safety evaluations including: – In-person audits of pilots, aircraft, mechanics and facilities by our in- house Head of Safety (former military, NYPD pilot and head of Fortune 50 corporate aviation department) – Insurance, maintenance, FAA and DOT records check, and pilot background checks ▪ Operators must also meet BLADE’s standards for customer experience and operational efficiency: – BLADE branded aircraft with “as-new” condition interiors and exteriors – Scheduled maintenance review (time between overhauls, annual inspections) – Use of BLADE’s operator dispatch and accounting dashboard technology PRIMARY ACCESSIBLE FLEET 22 BLADE standards of “flyability” of our missions are often more stringent than FAA guidelines |

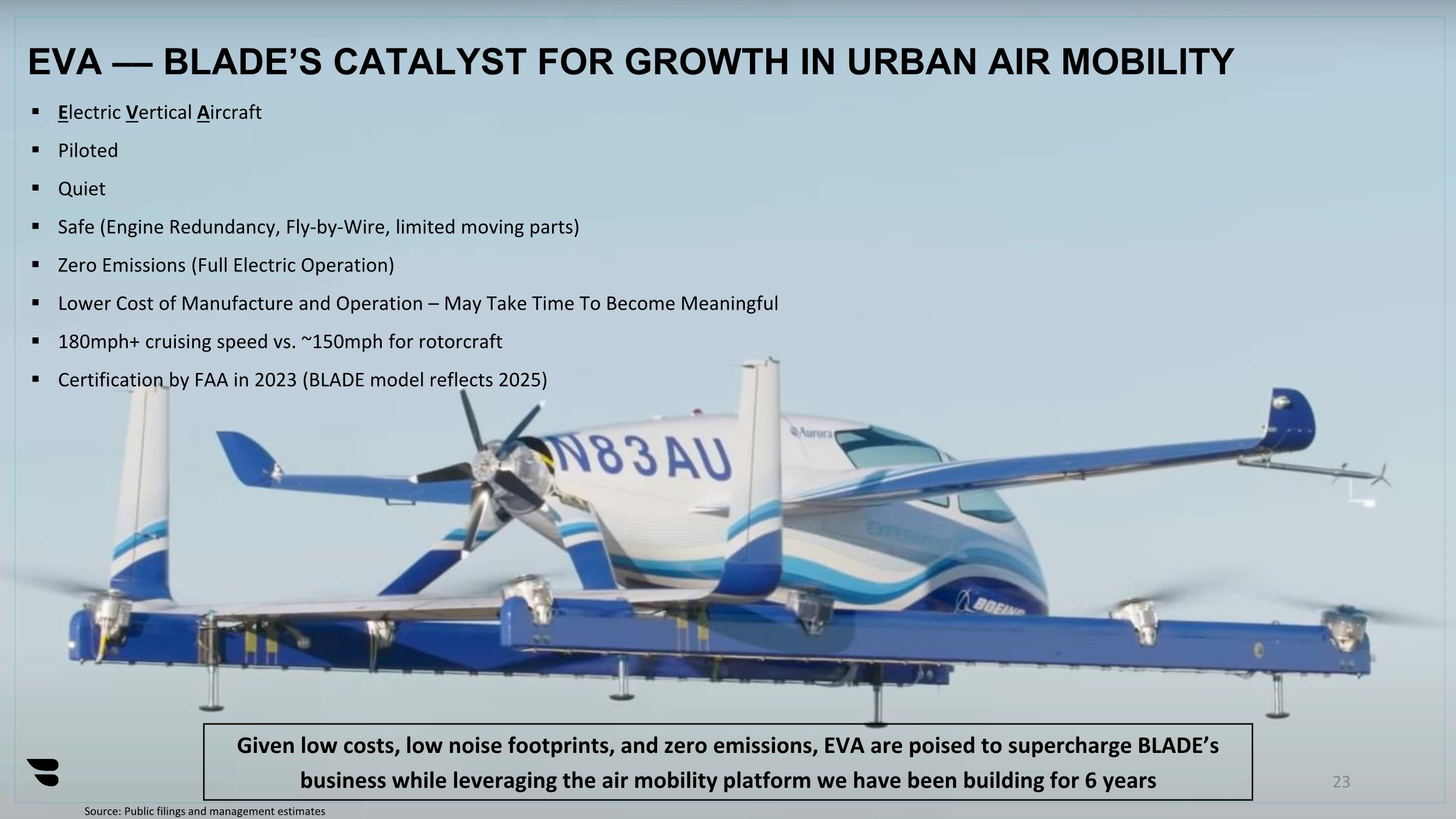

| EVA –– BLADE’S CATALYST FOR GROWTH IN URBAN AIR MOBILITY ▪ Electric Vertical Aircraft ▪ Piloted ▪ Quiet ▪ Safe (Engine Redundancy, Fly-by-Wire, limited moving parts) ▪ Zero Emissions (Full Electric Operation) ▪ Lower Cost of Manufacture and Operation – May Take Time To Become Meaningful ▪ 180mph+ cruising speed vs. ~150mph for rotorcraft ▪ Certification by FAA in 2023 (BLADE model reflects 2025) Given low costs, low noise footprints, and zero emissions, EVA are poised to supercharge BLADE’s business while leveraging the air mobility platform we have been building for 6 years Source: Public filings and management estimates 23 |

| OVER $6 BILLION INVESTED IN EVA OVER 5 YEARS Tens of thousands of successful flights across the universe of EVA platforms 24 Boeing • Major investments across the UAM landscape including Aurora Flight Sciences, SkyGrid, and Kitty Hawk/Wisk Lilium • $375 million raised • Developed and flown two variations of EVA prototypes Joby Aviation • $721 million raised, plus $1.5 billion expected from SPAC transaction • Began type certification program with FAA in 2018 • Received airworthiness approval by the U.S. Air Force for military use Volocopter • $438 million raised • Currently testing cargo-only EVA prototypes with lead customers • Passenger flights in Singapore and Dubai Airbus • Lead investor in BLADE’s Series B round • Developing airspace management system for EVA service • Performing trial flights for last mile cargo delivery BLADE Investor/Partner Bell • UAM alliance with BLADE BLADE Partner BETA • Partnered with U.S. Air Force’s Agility Prime project Archer Aviation • Expected to raise $1.1 billion through SPAC transaction • $1 billion order for aircraft from United Airlines |

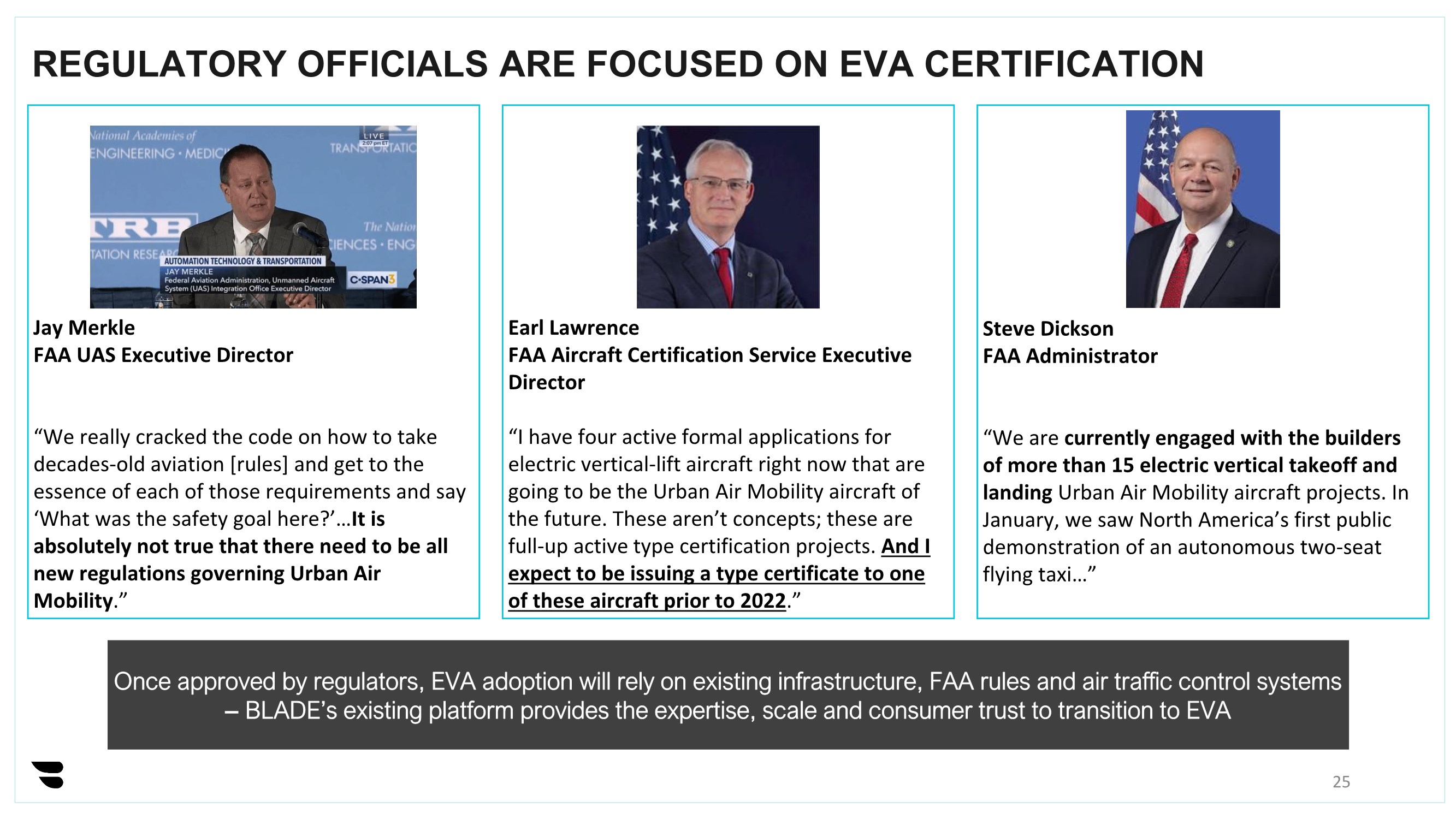

| REGULATORY OFFICIALS ARE FOCUSED ON EVA CERTIFICATION 25 Once approved by regulators, EVA adoption will rely on existing infrastructure, FAA rules and air traffic control systems – BLADE’s existing platform provides the expertise, scale and consumer trust to transition to EVA Jay Merkle FAA UAS Executive Director “We really cracked the code on how to take decades-old aviation [rules] and get to the essence of each of those requirements and say ‘What was the safety goal here?’…It is absolutely not true that there need to be all new regulations governing Urban Air Mobility.” Earl Lawrence FAA Aircraft Certification Service Executive Director “I have four active formal applications for electric vertical-lift aircraft right now that are going to be the Urban Air Mobility aircraft of the future. These aren’t concepts; these are full-up active type certification projects. And I expect to be issuing a type certificate to one of these aircraft prior to 2022.” Steve Dickson FAA Administrator “We are currently engaged with the builders of more than 15 electric vertical takeoff and landing Urban Air Mobility aircraft projects. In January, we saw North America’s first public demonstration of an autonomous two-seat flying taxi…” |

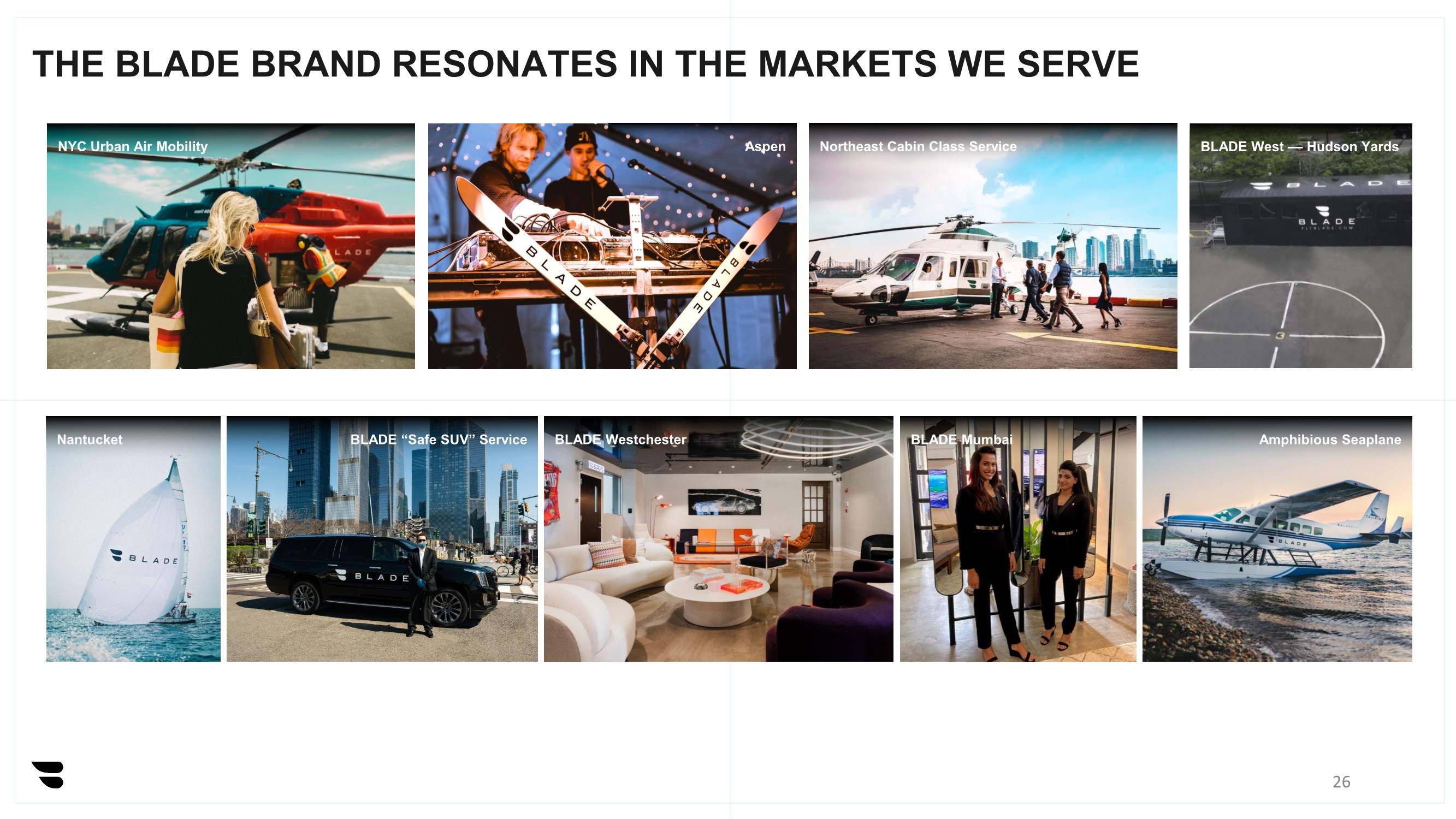

| THE BLADE BRAND RESONATES IN THE MARKETS WE SERVE 26 NYC Urban Air Mobility Aspen Northeast Cabin Class Service BLADE West –– Hudson Yards Nantucket BLADE “Safe SUV” Service Amphibious Seaplane BLADE Mumbai BLADE Westchester |

| Realty / Finance Beverages Entertainment Hospitality Transportation Fashion Beauty Technology BRANDS PARTNER WITH BLADE BLADE works with partners on a category exclusive basis to amplify flier exposure across BLADE’s suite of services and geographies. Deals are for cash, products, or services in-kind. 27 Note: Represents current and former BLADE partners. Coca-Cola Diageo Uber Disney+ |

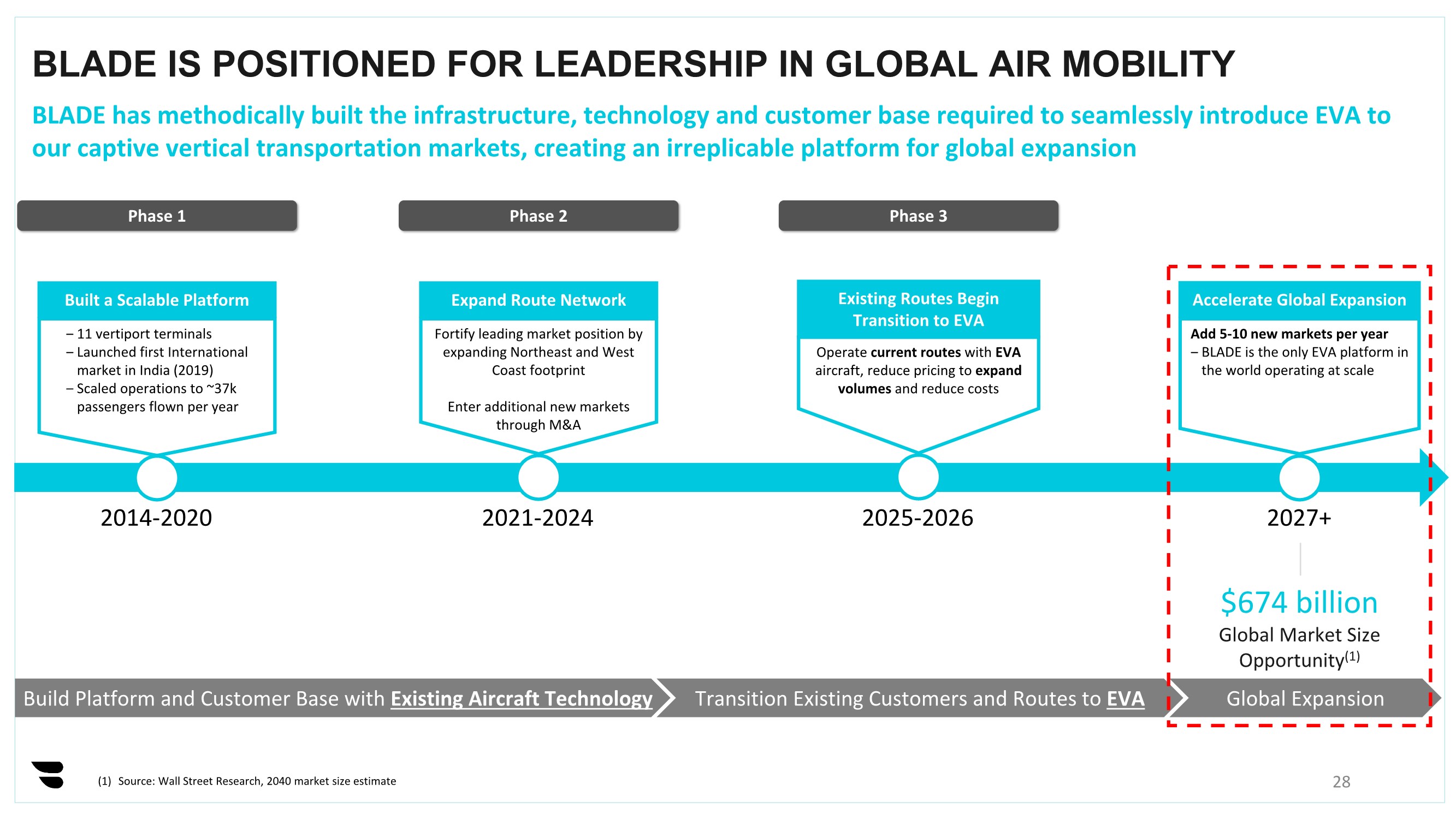

| BLADE IS POSITIONED FOR LEADERSHIP IN GLOBAL AIR MOBILITY 28 BLADE has methodically built the infrastructure, technology and customer base required to seamlessly introduce EVA to our captive vertical transportation markets, creating an irreplicable platform for global expansion Build Platform and Customer Base with Existing Aircraft Technology Transition Existing Customers and Routes to EVA Global Expansion ‒ 11 vertiport terminals ‒ Launched first International market in India (2019) ‒ Scaled operations to ~37k passengers flown per year Built a Scalable Platform 2014-2020 Expand Route Network Fortify leading market position by expanding Northeast and West Coast footprint Enter additional new markets through M&A 2021-2024 Existing Routes Begin Transition to EVA Operate current routes with EVA aircraft, reduce pricing to expand volumes and reduce costs 2025-2026 $674 billion Global Market Size Opportunity(1) Accelerate Global Expansion Add 5-10 new markets per year ‒ BLADE is the only EVA platform in the world operating at scale 2027+ (1) Source: Wall Street Research, 2040 market size estimate Phase 1 Phase 2 Phase 3 |

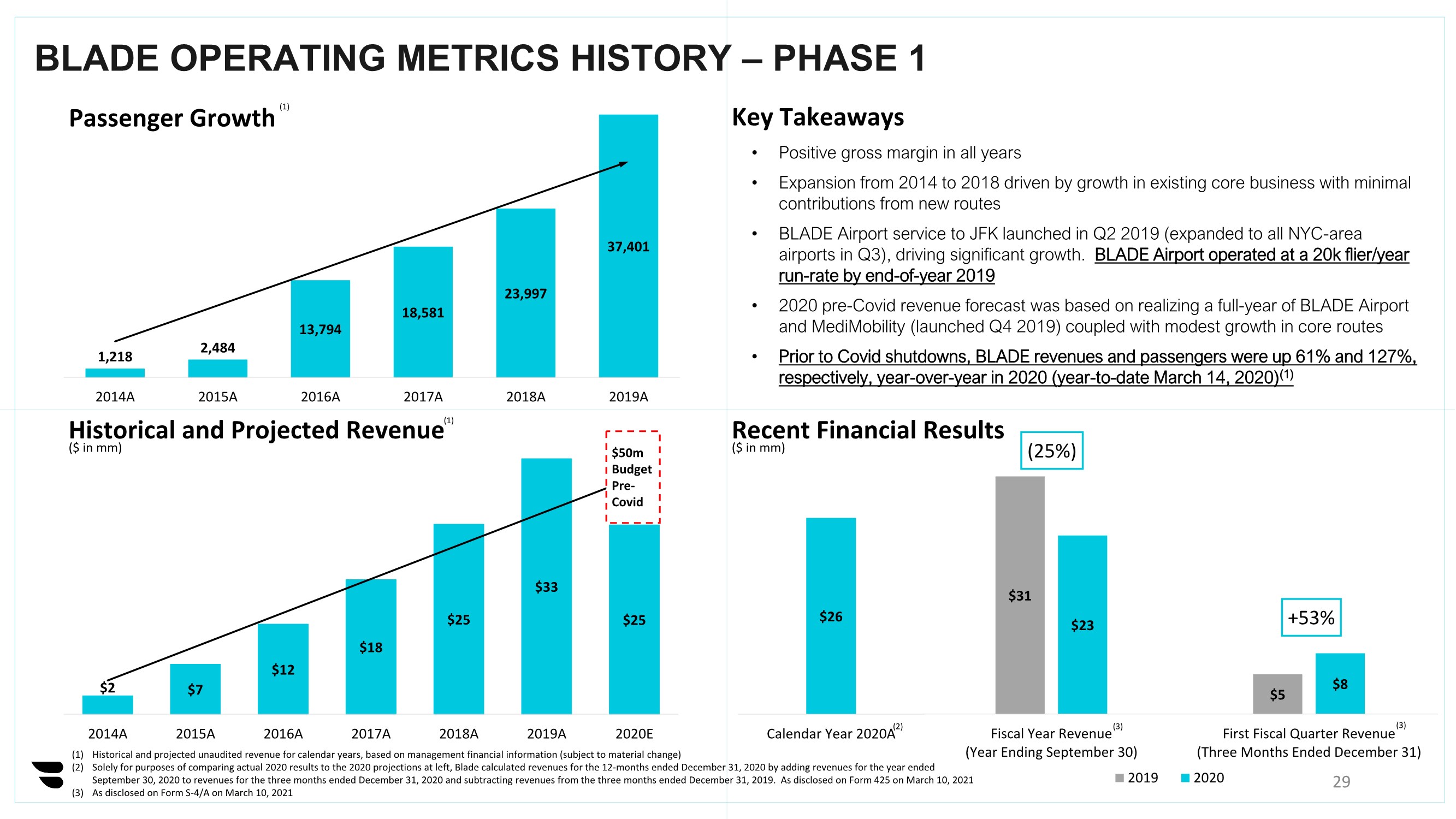

| Historical and Projected Revenue $2 $7 $12 $18 $25 $33 $25 2014A 2015A 2016A 2017A 2018A 2019A 2020E BLADE OPERATING METRICS HISTORY – PHASE 1 • Positive gross margin in all years • Expansion from 2014 to 2018 driven by growth in existing core business with minimal contributions from new routes • BLADE Airport service to JFK launched in Q2 2019 (expanded to all NYC-area airports in Q3), driving significant growth. BLADE Airport operated at a 20k flier/year run-rate by end-of-year 2019 • 2020 pre-Covid revenue forecast was based on realizing a full-year of BLADE Airport and MediMobility (launched Q4 2019) coupled with modest growth in core routes • Prior to Covid shutdowns, BLADE revenues and passengers were up 61% and 127%, respectively, year-over-year in 2020 (year-to-date March 14, 2020)(1) Key Takeaways (1) Historical and projected unaudited revenue for calendar years, based on management financial information (subject to material change) (2) Solely for purposes of comparing actual 2020 results to the 2020 projections at left, Blade calculated revenues for the 12-months ended December 31, 2020 by adding revenues for the year ended September 30, 2020 to revenues for the three months ended December 31, 2020 and subtracting revenues from the three months ended December 31, 2019. As disclosed on Form 425 on March 10, 2021 (3) As disclosed on Form S-4/A on March 10, 2021 (1) (1) Passenger Growth ($ in mm) Recent Financial Results ($ in mm) 1,218 2,484 13,794 18,581 23,997 37,401 2014A 2015A 2016A 2017A 2018A 2019A $50m Budget Pre- Covid 29 $31 $5 $23 $8 Fiscal Year Revenue (Year Ending September 30) First Fiscal Quarter Revenue (Three Months Ended December 31) 2019 2020 $26 Calendar Year 2020A (3) (25%) +53% (2) (3) |

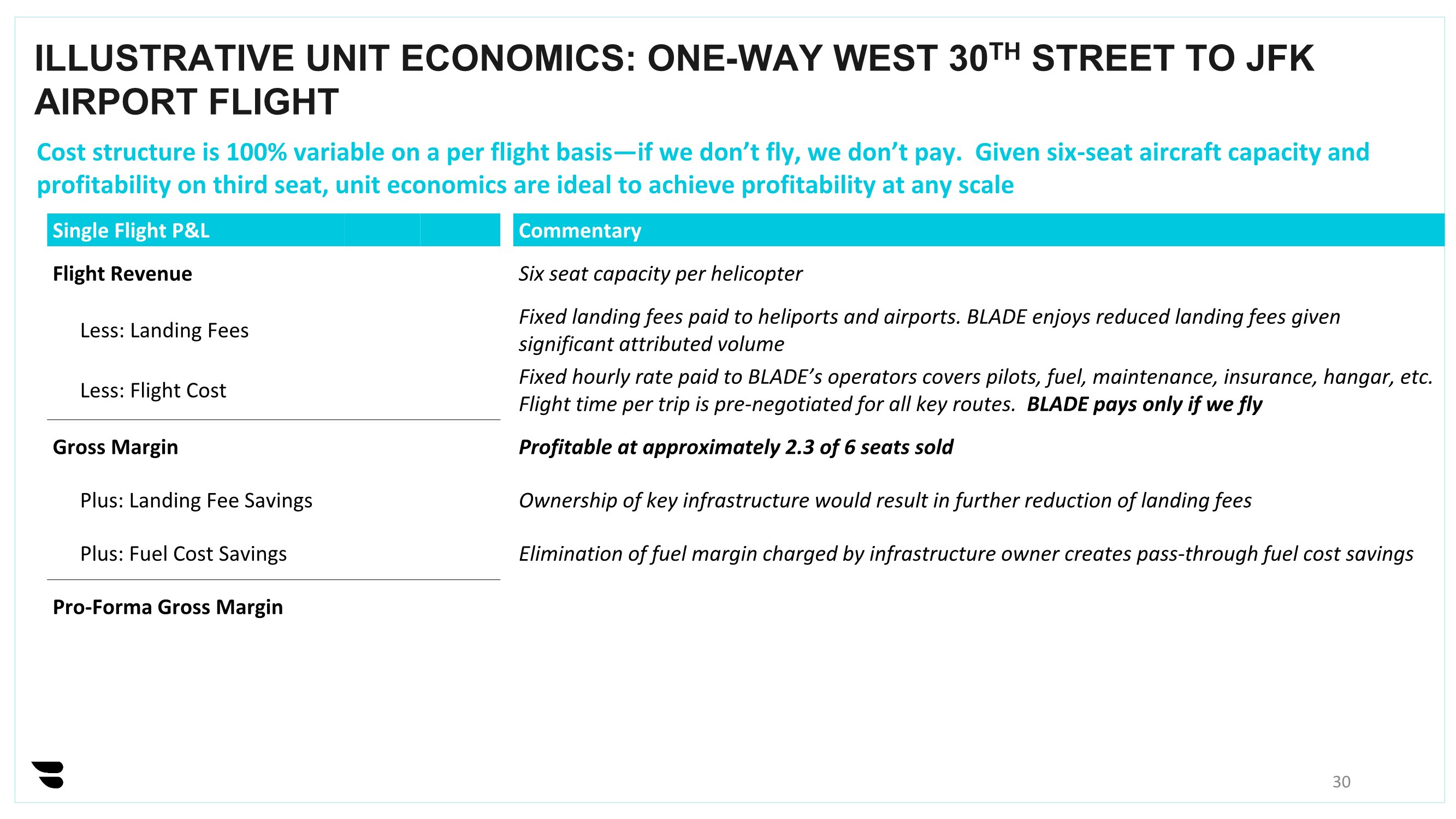

| ILLUSTRATIVE UNIT ECONOMICS: ONE-WAY WEST 30TH STREET TO JFK AIRPORT FLIGHT Single Flight P&L Commentary Flight Revenue Six seat capacity per helicopter Less: Landing Fees Fixed landing fees paid to heliports and airports. BLADE enjoys reduced landing fees given significant attributed volume Less: Flight Cost Fixed hourly rate paid to BLADE’s operators covers pilots, fuel, maintenance, insurance, hangar, etc. Flight time per trip is pre-negotiated for all key routes. BLADE pays only if we fly Gross Margin Profitable at approximately 2.3 of 6 seats sold Plus: Landing Fee Savings Ownership of key infrastructure would result in further reduction of landing fees Plus: Fuel Cost Savings Elimination of fuel margin charged by infrastructure owner creates pass-through fuel cost savings Pro-Forma Gross Margin 30 Cost structure is 100% variable on a per flight basis—if we don’t fly, we don’t pay. Given six-seat aircraft capacity and profitability on third seat, unit economics are ideal to achieve profitability at any scale |

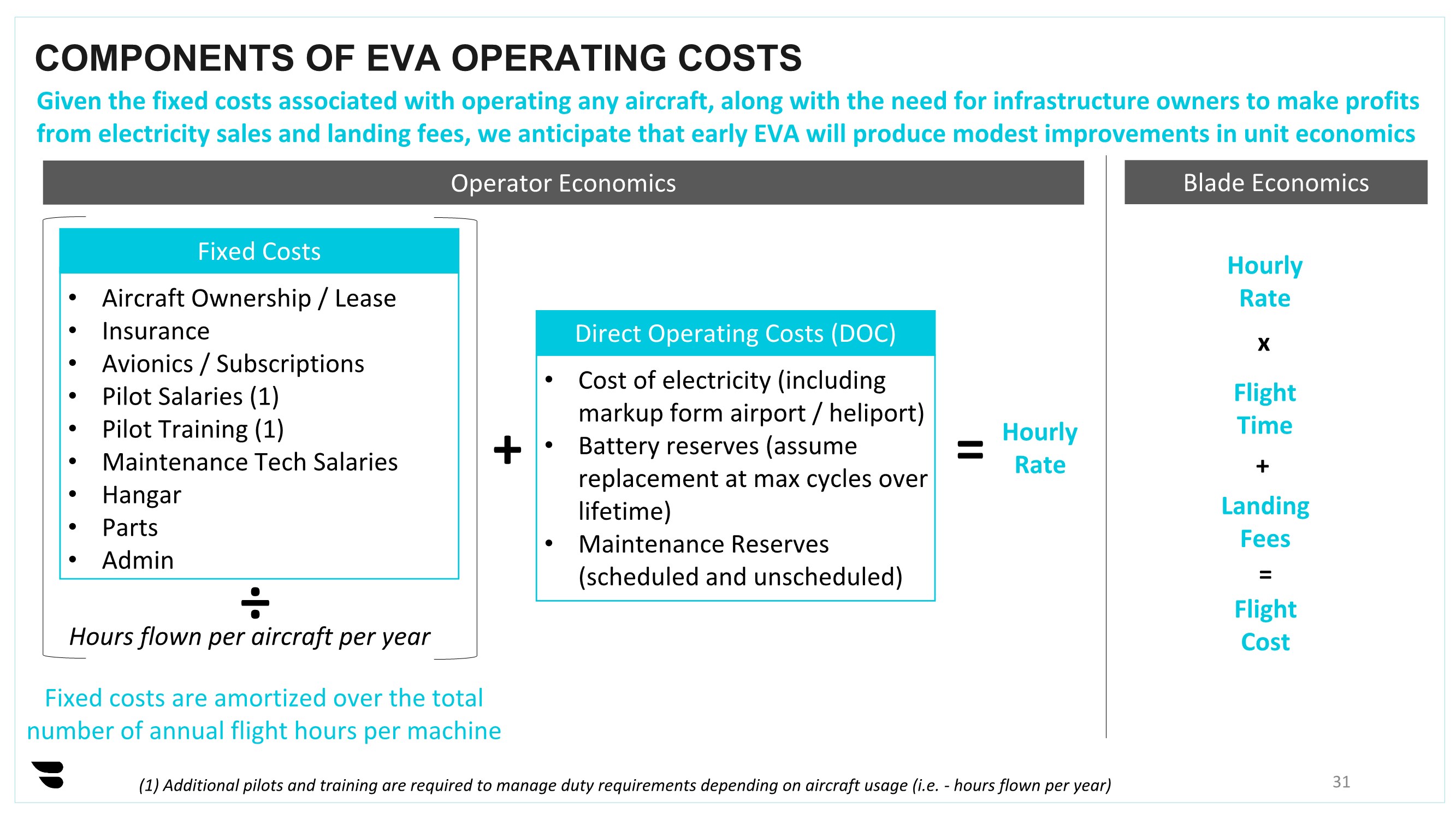

| COMPONENTS OF EVA OPERATING COSTS 31 Given the fixed costs associated with operating any aircraft, along with the need for infrastructure owners to make profits from electricity sales and landing fees, we anticipate that early EVA will produce modest improvements in unit economics Fixed Costs • Aircraft Ownership / Lease • Insurance • Avionics / Subscriptions • Pilot Salaries (1) • Pilot Training (1) • Maintenance Tech Salaries • Hangar • Parts • Admin ÷ Hours flown per aircraft per year Fixed costs are amortized over the total number of annual flight hours per machine + Direct Operating Costs (DOC) • Cost of electricity (including markup form airport / heliport) • Battery reserves (assume replacement at max cycles over lifetime) • Maintenance Reserves (scheduled and unscheduled) (1) Additional pilots and training are required to manage duty requirements depending on aircraft usage (i.e. - hours flown per year) = Hourly Rate Hourly Rate x Flight Time + Landing Fees Flight Cost = Operator Economics Blade Economics |

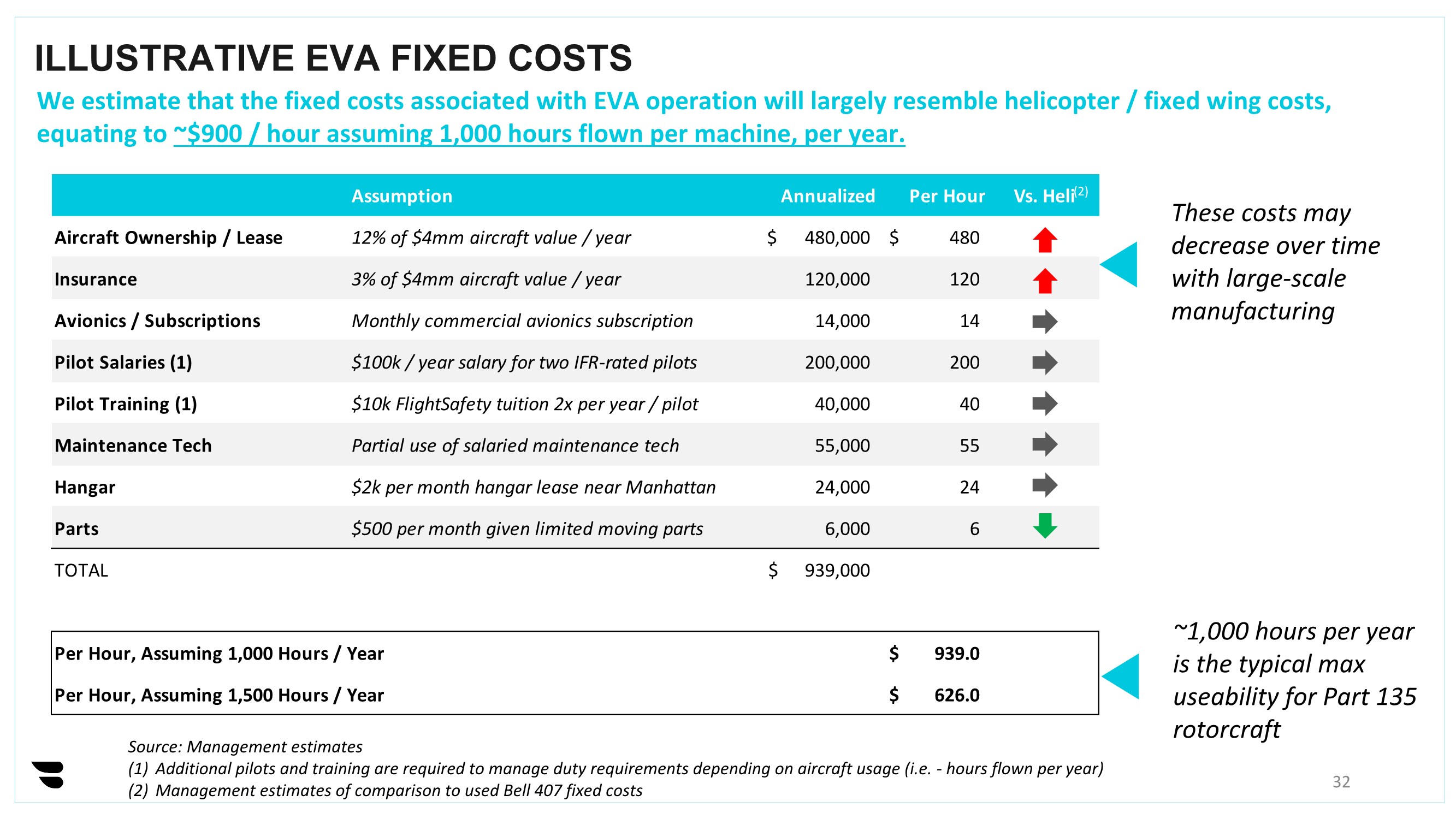

| Assumption Annualized Per Hour Vs. Heli Aircraft Ownership / Lease 12% of $4mm aircraft value / year 480,000 $ 480 $ Insurance 3% of $4mm aircraft value / year 120,000 120 Avionics / Subscriptions Monthly commercial avionics subscription 14,000 14 Pilot Salaries (1) $100k / year salary for two IFR-rated pilots 200,000 200 Pilot Training (1) $10k FlightSafety tuition 2x per year / pilot 40,000 40 Maintenance Tech Partial use of salaried maintenance tech 55,000 55 Hangar $2k per month hangar lease near Manhattan 24,000 24 Parts $500 per month given limited moving parts 6,000 6 TOTAL 939,000 $ Per Hour, Assuming 1,000 Hours / Year 939.0 $ Per Hour, Assuming 1,500 Hours / Year 626.0 $ ILLUSTRATIVE EVA FIXED COSTS 32 We estimate that the fixed costs associated with EVA operation will largely resemble helicopter / fixed wing costs, equating to ~$900 / hour assuming 1,000 hours flown per machine, per year. Source: Management estimates (1) Additional pilots and training are required to manage duty requirements depending on aircraft usage (i.e. - hours flown per year) (2) Management estimates of comparison to used Bell 407 fixed costs ~1,000 hours per year is the typical max useability for Part 135 rotorcraft These costs may decrease over time with large-scale manufacturing (2) |

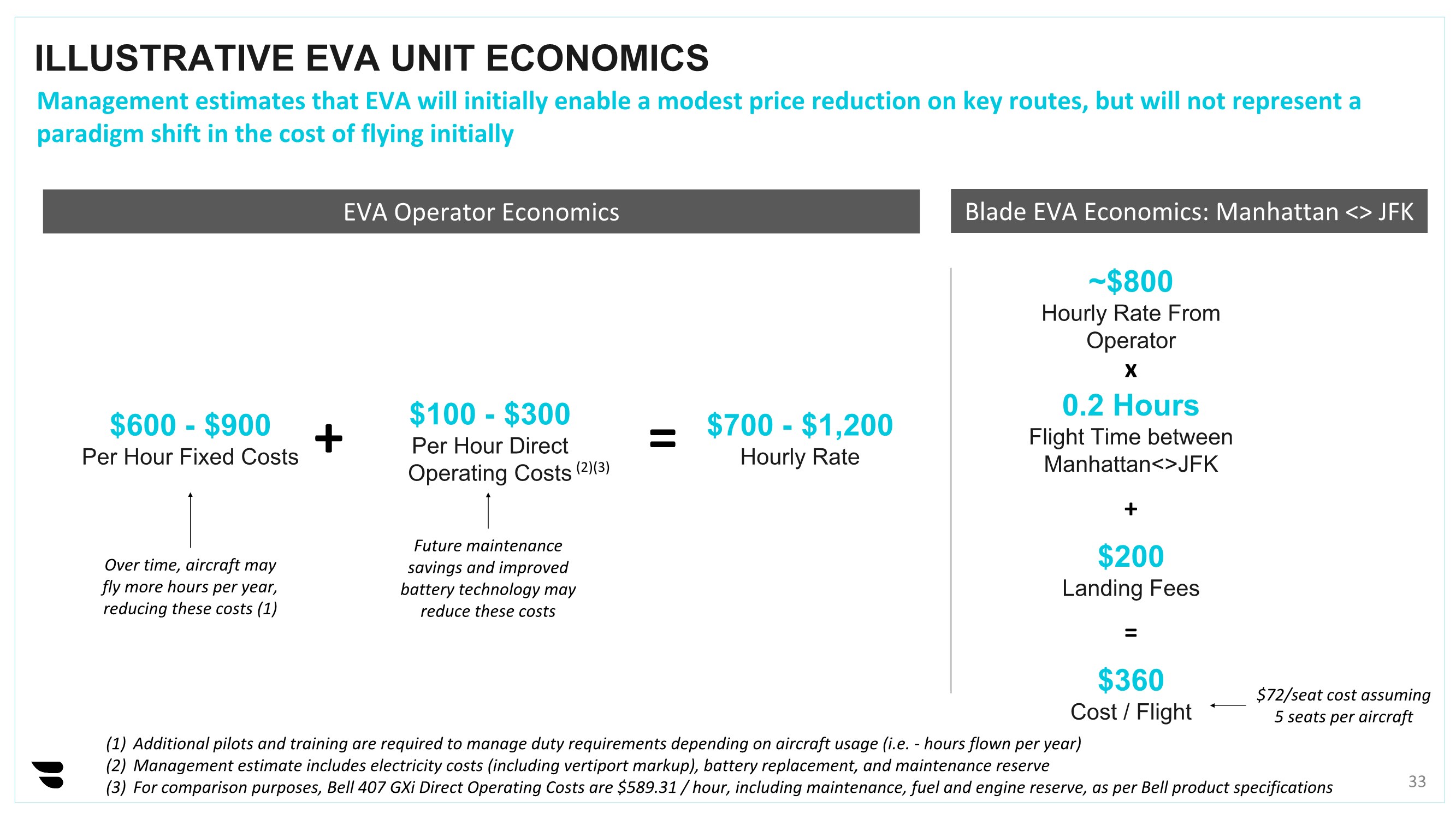

| ILLUSTRATIVE EVA UNIT ECONOMICS 33 Management estimates that EVA will initially enable a modest price reduction on key routes, but will not represent a paradigm shift in the cost of flying initially + (1) Additional pilots and training are required to manage duty requirements depending on aircraft usage (i.e. - hours flown per year) (2) Management estimate includes electricity costs (including vertiport markup), battery replacement, and maintenance reserve (3) For comparison purposes, Bell 407 GXi Direct Operating Costs are $589.31 / hour, including maintenance, fuel and engine reserve, as per Bell product specifications = x + = EVA Operator Economics Blade EVA Economics: Manhattan <> JFK $600 - $900 Per Hour Fixed Costs $100 - $300 Per Hour Direct Operating Costs $700 - $1,200 Hourly Rate ~$800 Hourly Rate From Operator 0.2 Hours Flight Time between Manhattan<>JFK $200 Landing Fees $360 Cost / Flight Over time, aircraft may fly more hours per year, reducing these costs (1) Future maintenance savings and improved battery technology may reduce these costs $72/seat cost assuming 5 seats per aircraft (2)(3) |

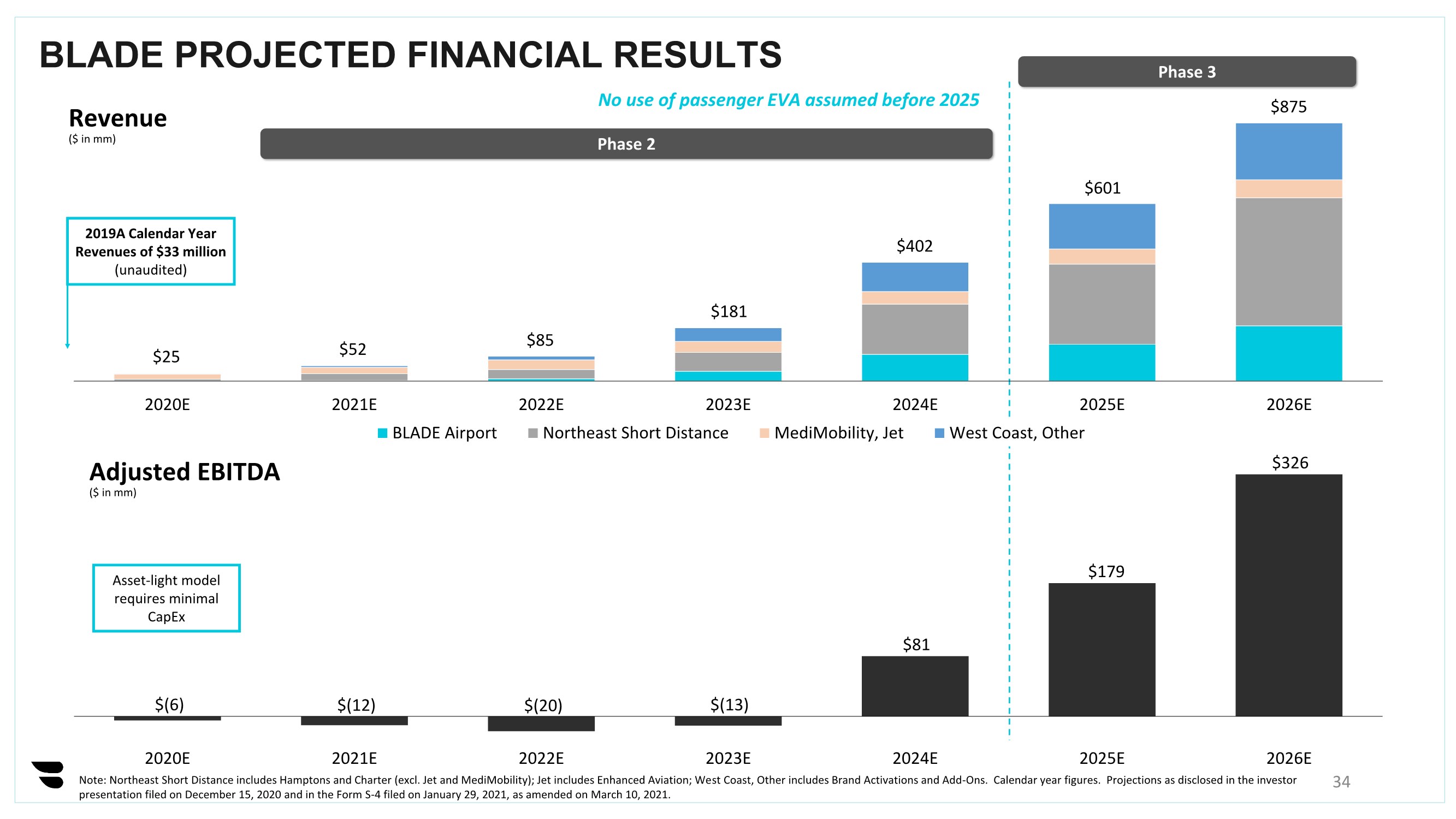

| $(6) $(12) $(20) $(13) $81 $179 $326 2020E 2021E 2022E 2023E 2024E 2025E 2026E BLADE PROJECTED FINANCIAL RESULTS Revenue ($ in mm) Adjusted EBITDA ($ in mm) Note: Northeast Short Distance includes Hamptons and Charter (excl. Jet and MediMobility); Jet includes Enhanced Aviation; West Coast, Other includes Brand Activations and Add-Ons. Calendar year figures. Projections as disclosed in the investor presentation filed on December 15, 2020 and in the Form S-4 filed on January 29, 2021, as amended on March 10, 2021. 2020E 2021E 2022E 2023E 2024E 2025E 2026E BLADE Airport Northeast Short Distance MediMobility, Jet West Coast, Other $25 $52 $85 $181 $402 $601 $875 No use of passenger EVA assumed before 2025 2019A Calendar Year Revenues of $33 million (unaudited) Phase 2 Phase 3 34 Asset-light model requires minimal CapEx |

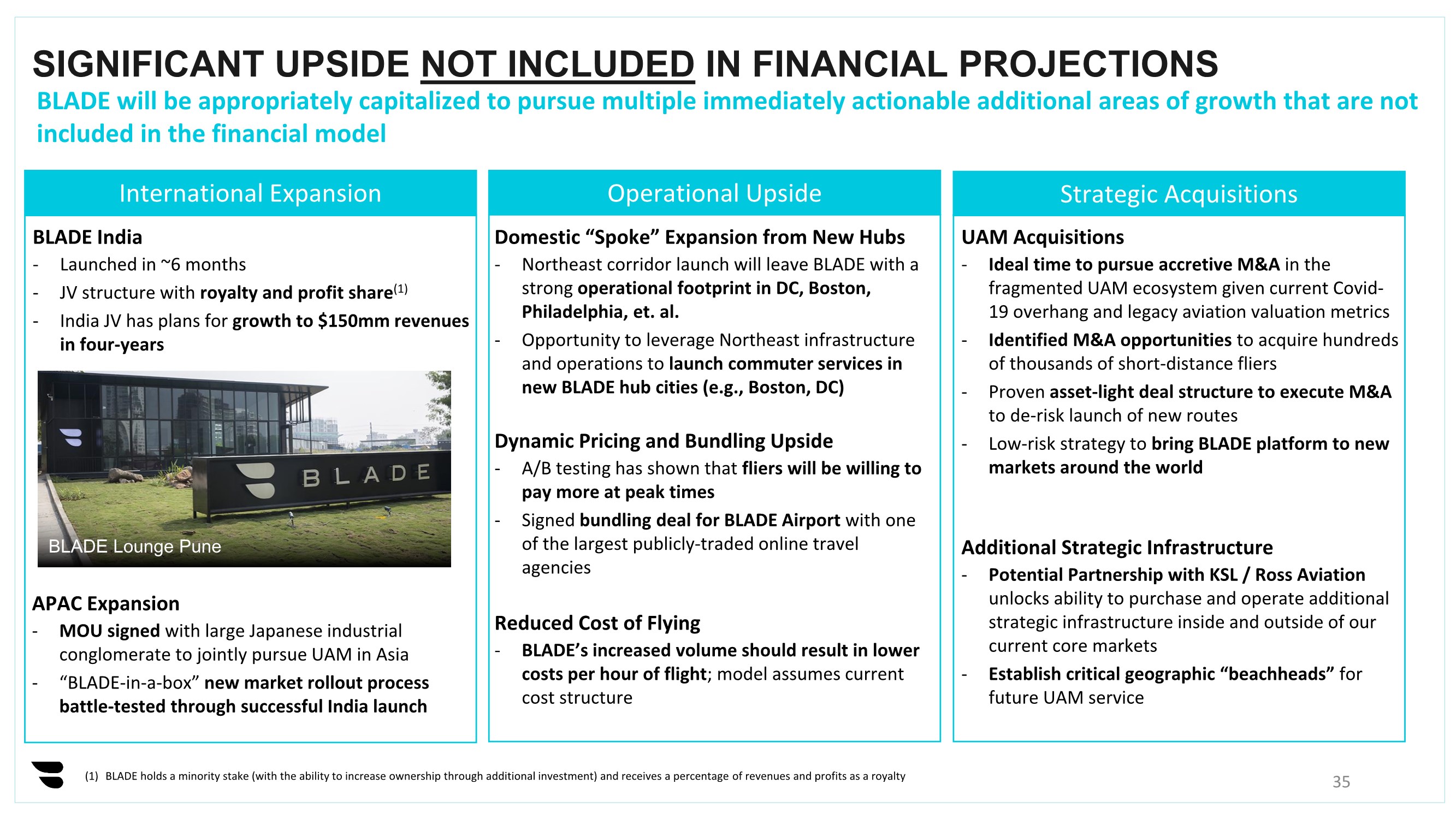

| SIGNIFICANT UPSIDE NOT INCLUDED IN FINANCIAL PROJECTIONS 35 BLADE will be appropriately capitalized to pursue multiple immediately actionable additional areas of growth that are not included in the financial model International Expansion Strategic Acquisitions Operational Upside BLADE India - Launched in ~6 months - JV structure with royalty and profit share(1) - India JV has plans for growth to $150mm revenues in four-years BLADE Lounge Pune APAC Expansion - MOU signed with large Japanese industrial conglomerate to jointly pursue UAM in Asia -“BLADE-in-a-box” new market rollout process battle-tested through successful India launch UAM Acquisitions - Ideal time to pursue accretive M&A in the fragmented UAM ecosystem given current Covid- 19 overhang and legacy aviation valuation metrics - Identified M&A opportunities to acquire hundreds of thousands of short-distance fliers - Proven asset-light deal structure to execute M&A to de-risk launch of new routes - Low-risk strategy to bring BLADE platform to new markets around the world Additional Strategic Infrastructure - Potential Partnership with KSL / Ross Aviation unlocks ability to purchase and operate additional strategic infrastructure inside and outside of our current core markets - Establish critical geographic “beachheads” for future UAM service Domestic “Spoke” Expansion from New Hubs - Northeast corridor launch will leave BLADE with a strong operational footprint in DC, Boston, Philadelphia, et. al. - Opportunity to leverage Northeast infrastructure and operations to launch commuter services in new BLADE hub cities (e.g., Boston, DC) Dynamic Pricing and Bundling Upside - A/B testing has shown that fliers will be willing to pay more at peak times - Signed bundling deal for BLADE Airport with one of the largest publicly-traded online travel agencies Reduced Cost of Flying - BLADE’s increased volume should result in lower costs per hour of flight; model assumes current cost structure (1) BLADE holds a minority stake (with the ability to increase ownership through additional investment) and receives a percentage of revenues and profits as a royalty |

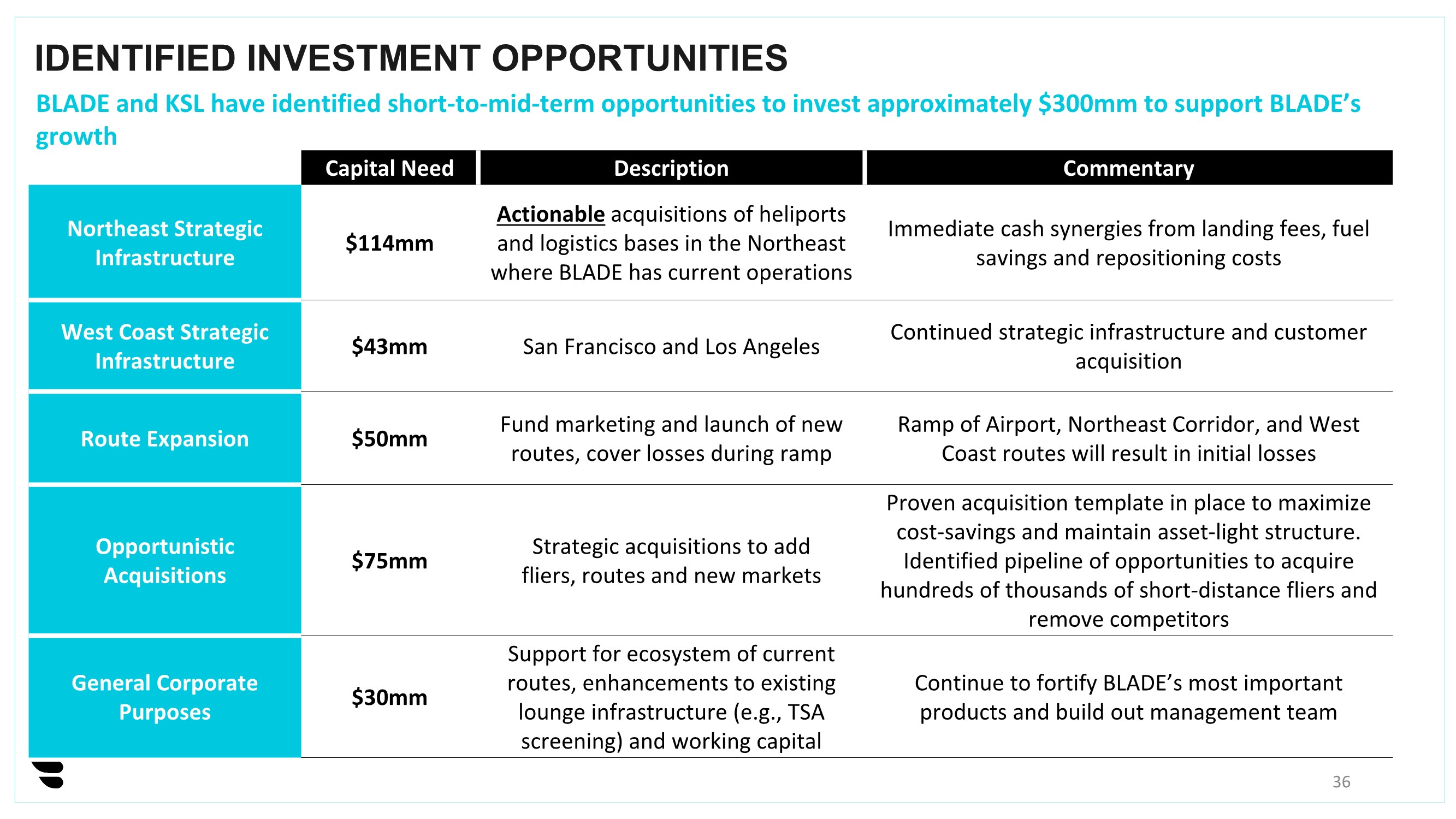

| Capital Need Description CommentaryNortheast Strategic Infrastructure $114mm Actionable acquisitions of heliports and logistics bases in the Northeast where BLADE has current operations Immediate cash synergies from landing fees, fuel savings and repositioning costs West Coast Strategic Infrastructure $43mm San Francisco and Los Angeles Continued strategic infrastructure and customer acquisition Route Expansion $50mm Fund marketing and launch of new routes, cover losses during ramp Ramp of Airport, Northeast Corridor, and West Coast routes will result in initial losses Opportunistic Acquisitions $75mm Strategic acquisitions to add fliers, routes and new markets Proven acquisition template in place to maximize cost-savings and maintain asset-light structure. Identified pipeline of opportunities to acquire hundreds of thousands of short-distance fliers and remove competitors General Corporate Purposes $30mm Support for ecosystem of current routes, enhancements to existing lounge infrastructure (e.g., TSA screening) and working capital Continue to fortify BLADE’s most important products and build out management team IDENTIFIED INVESTMENT OPPORTUNITIES BLADE and KSL have identified short-to-mid-term opportunities to invest approximately $300mm to support BLADE’s growth 36 |

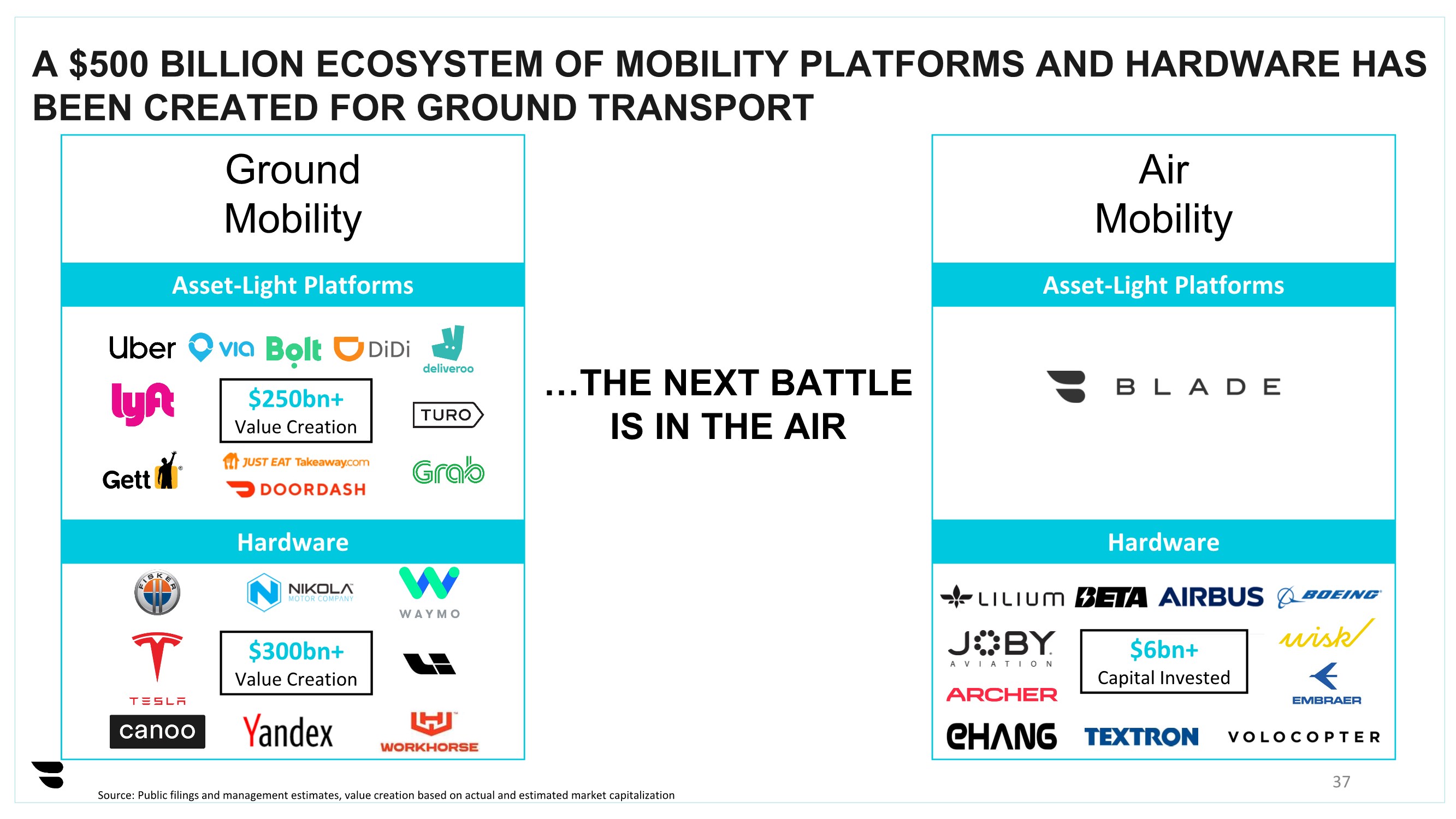

| A $500 BILLION ECOSYSTEM OF MOBILITY PLATFORMS AND HARDWARE HAS BEEN CREATED FOR GROUND TRANSPORT 37 …THE NEXT BATTLE IS IN THE AIR Ground Mobility Hardware $300bn+ Value Creation Asset-Light Platforms $250bn+ Value Creation Air Mobility Asset-Light Platforms Hardware $6bn+ Capital Invested Source: Public filings and management estimates, value creation based on actual and estimated market capitalization |

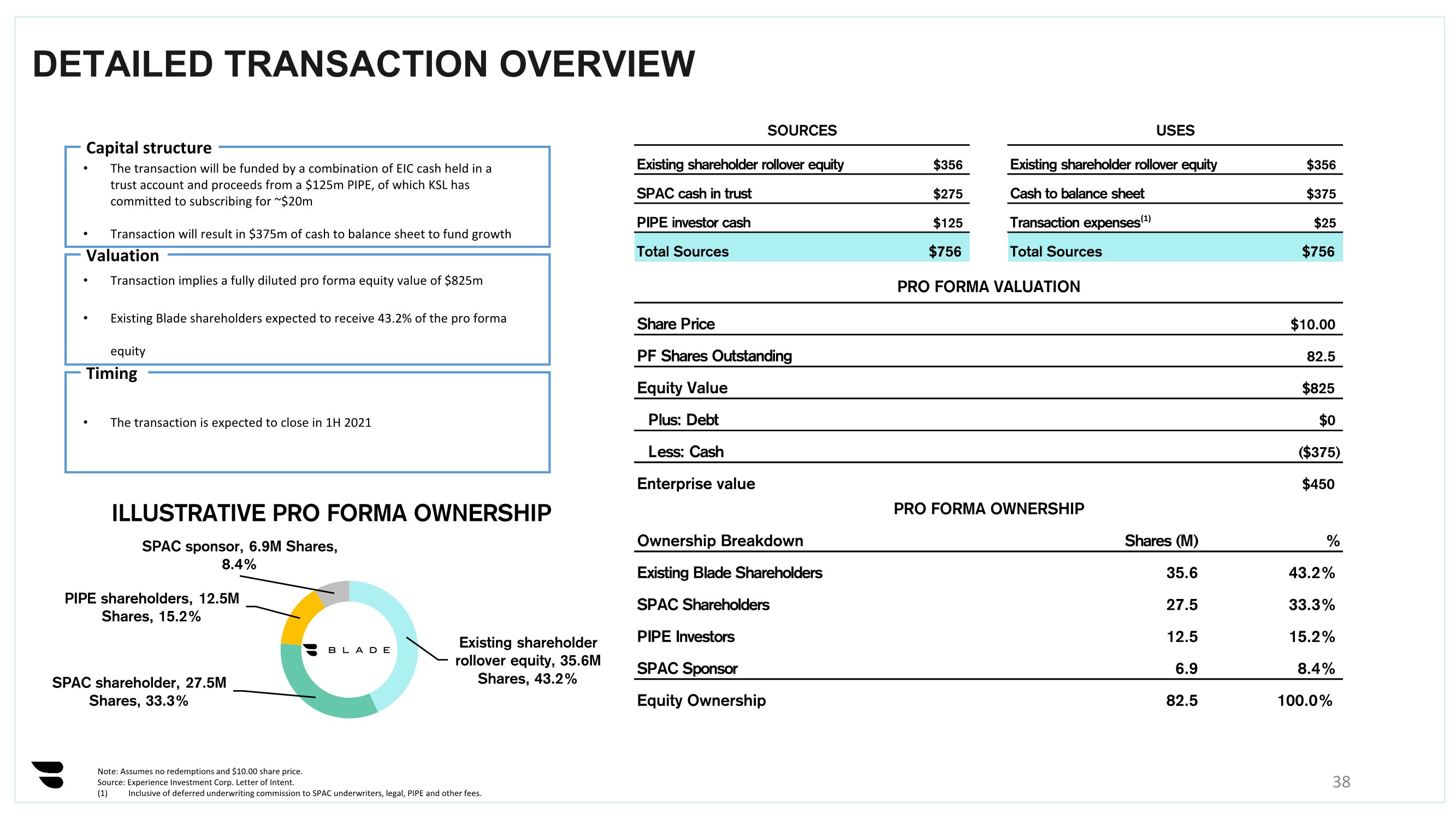

| DETAILED TRANSACTION OVERVIEW 38 Timing • The transaction is expected to close in 1H 2021 Valuation • Transaction implies a fully diluted pro forma equity value of $825m • Existing Blade shareholders expected to receive 43.2% of the pro forma equity Capital structure • The transaction will be funded by a combination of EIC cash held in a trust account and proceeds from a $125m PIPE, of which KSL has committed to subscribing for ~$20m • Transaction will result in $375m of cash to balance sheet to fund growth Note: Assumes no redemptions and $10.00 share price. Source: Experience Investment Corp. Letter of Intent. (1) Inclusive of deferred underwriting commission to SPAC underwriters, legal, PIPE and other fees. (1) SOURCES PRO FORMA VALUATION Existing shareholder rollover equity $356 SPAC cash in trust $275 PIPE investor cash $125 Total Sources $756 USES ILLUSTRATIVE PRO FORMA OWNERSHIP Existing shareholder rollover equity $356 Cash to balance sheet $375 Transaction expenses $25 Total Sources $756 PRO FORMA OWNERSHIP Ownership Breakdown Shares (M) % Existing Blade Shareholders 35.6 43.2% SPAC Shareholders 27.5 33.3% PIPE Investors 12.5 15.2% SPAC Sponsor 6.9 8.4% Equity Ownership 82.5 100.0% PRO FORMA VALUATION Share Price $10.00 PF Shares Outstanding 82.5 Equity Value $825 Plus: Debt $0 Less: Cash ($375) Enterprise value $450 ILLUSTRATIVE PRO FORMA OWNERSHIP Existing shareholder rollover equity, 35.6M Shares, 43.2% SPAC shareholder, 27.5M Shares, 33.3% PIPE shareholders, 12.5M Shares, 15.2% SPAC sponsor, 6.9M Shares, 8.4% |

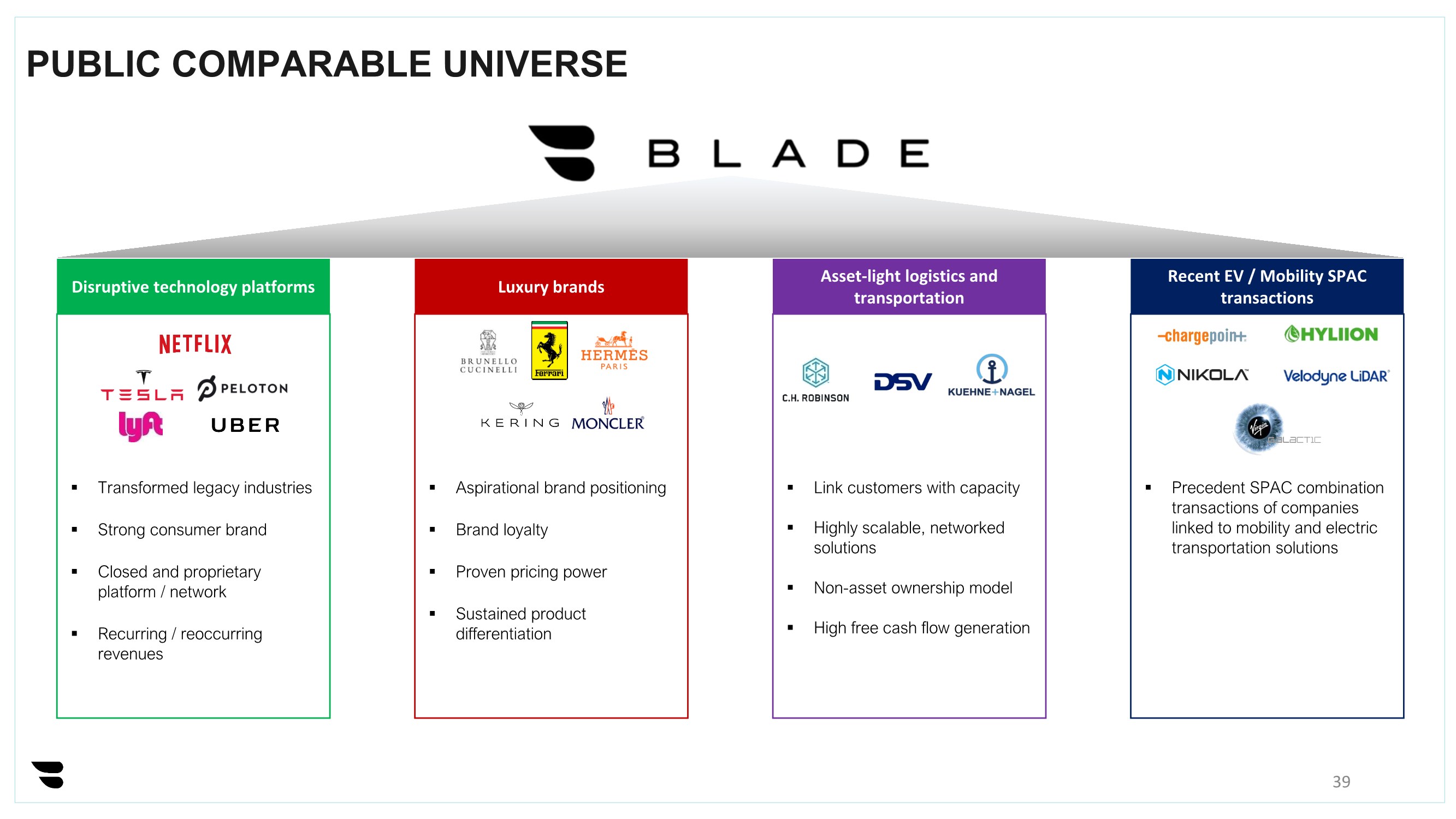

| PUBLIC COMPARABLE UNIVERSE 39 Luxury brands Asset-light logistics and transportation Recent EV / Mobility SPAC transactions ▪ Aspirational brand positioning ▪ Brand loyalty ▪ Proven pricing power ▪ Sustained product differentiation ▪ Link customers with capacity ▪ Highly scalable, networked solutions ▪ Non-asset ownership model ▪ High free cash flow generation ▪ Precedent SPAC combination transactions of companies linked to mobility and electric transportation solutions Disruptive technology platforms ▪ Transformed legacy industries ▪ Strong consumer brand ▪ Closed and proprietary platform / network ▪ Recurring / reoccurring revenues |

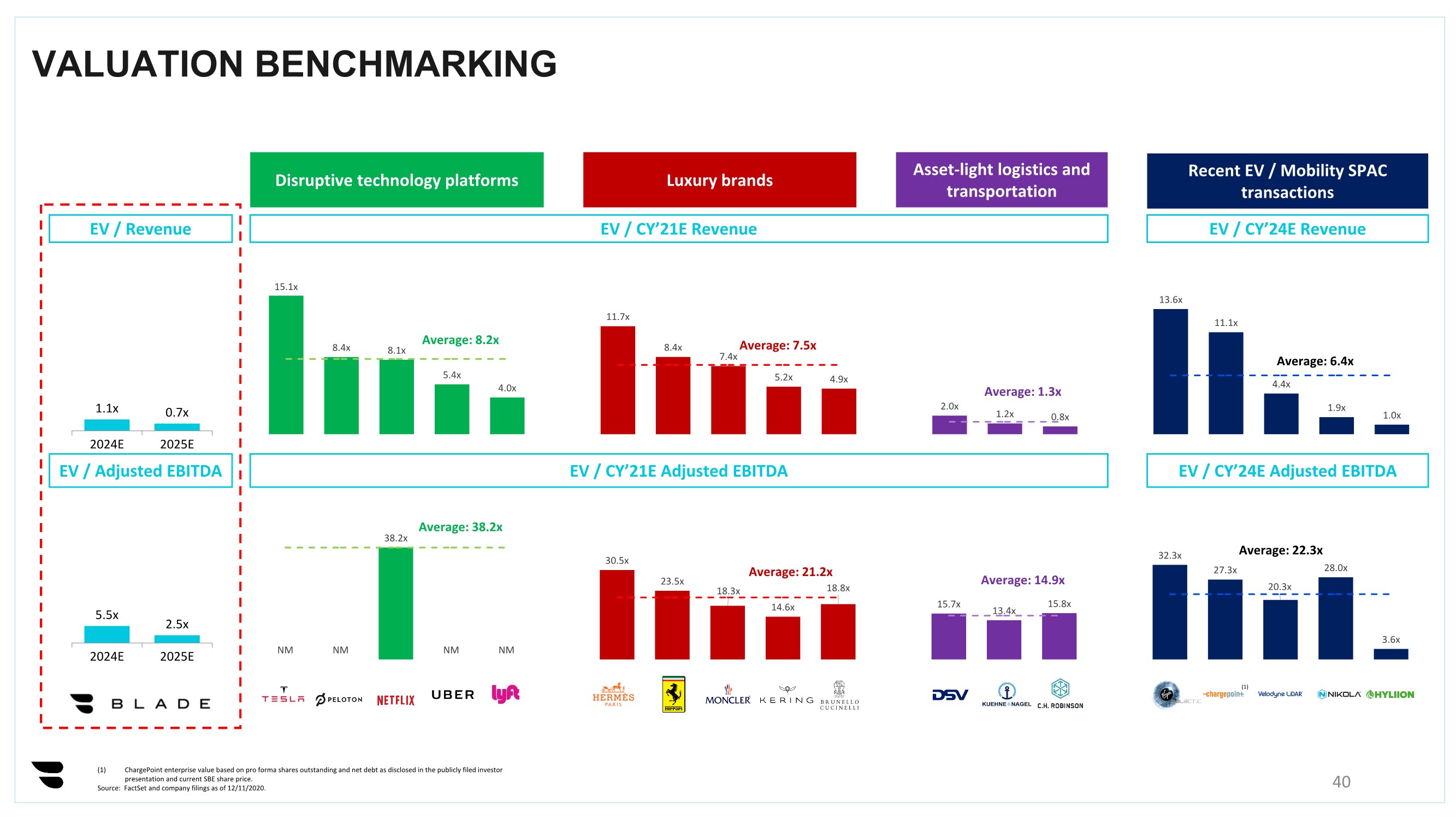

| 15.1x 8.4x 8.1x 5.4x 4.0x 11.7x 8.4x 7.4x 5.2x 4.9x 2.0x 1.2x 0.8x 13.6x 11.1x 4.4x 1.9x 1.0x NM NM 38.2x NM NM 30.5x 23.5x 18.3x 14.6x 18.8x 15.7x 13.4x 15.8x 32.3x 27.3x 20.3x 28.0x 3.6x VALUATION BENCHMARKING 40 (1) ChargePoint enterprise value based on pro forma shares outstanding and net debt as disclosed in the publicly filed investor presentation and current SBE share price. Source: FactSet and company filings as of 12/11/2020. Luxury brands Asset-light logistics and transportation Recent EV / Mobility SPAC transactions (1) EV / CY’21E Revenue EV / CY’24E Revenue EV / CY’21E Adjusted EBITDA EV / CY’24E Adjusted EBITDA EV / Revenue EV / Adjusted EBITDA Disruptive technology platforms 5.5x 2.5x 2024E 2025E 1.1x 0.7x 2024E 2025E Average: 7.5x Average: 21.2x Average: 1.3x Average: 14.9x Average: 6.4x Average: 22.3x Average: 8.2x Average: 38.2x |

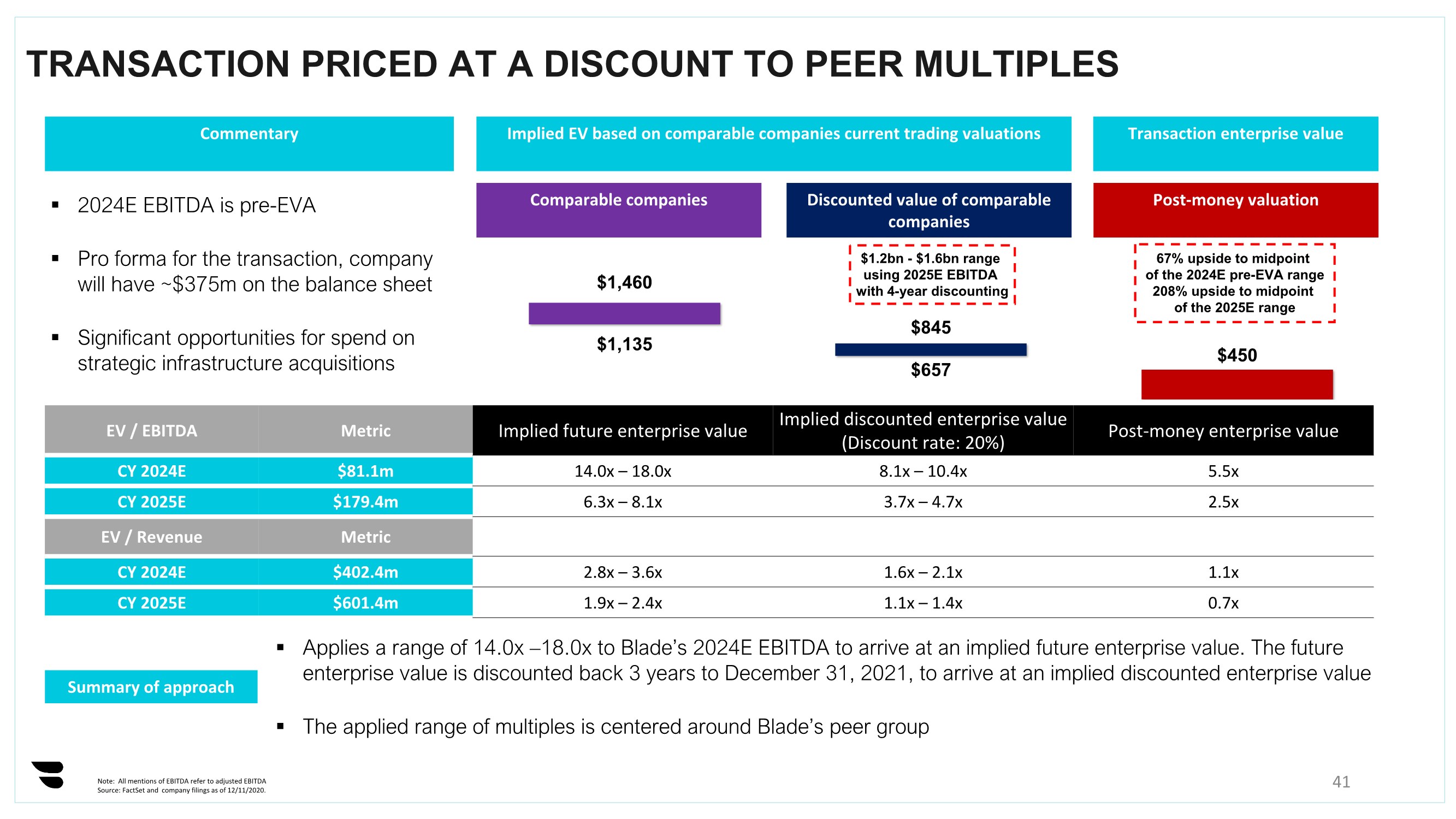

| TRANSACTION PRICED AT A DISCOUNT TO PEER MULTIPLES 41 Note: All mentions of EBITDA refer to adjusted EBITDA Source: FactSet and company filings as of 12/11/2020. $1,135 $657 $1,460 $845 $450 Implied EV based on comparable companies current trading valuations Transaction enterprise value Comparable companies Discounted value of comparable companies Post-money valuation ▪ 2024E EBITDA is pre-EVA ▪ Pro forma for the transaction, company will have ~$375m on the balance sheet ▪ Significant opportunities for spend on strategic infrastructure acquisitions EV / EBITDA Metric Implied future enterprise value Implied discounted enterprise value (Discount rate: 20%) Post-money enterprise value CY 2024E $81.1m 14.0x – 18.0x 8.1x – 10.4x 5.5x CY 2025E $179.4m 6.3x – 8.1x 3.7x – 4.7x 2.5x EV / Revenue Metric CY 2024E $402.4m 2.8x – 3.6x 1.6x – 2.1x 1.1x CY 2025E $601.4m 1.9x – 2.4x 1.1x – 1.4x 0.7x Commentary ▪ Applies a range of 14.0x –18.0x to Blade’s 2024E EBITDA to arrive at an implied future enterprise value. The future enterprise value is discounted back 3 years to December 31, 2021, to arrive at an implied discounted enterprise value ▪ The applied range of multiples is centered around Blade’s peer group Summary of approach $1.2bn - $1.6bn range using 2025E EBITDA with 4-year discounting 67% upside to midpoint of the 2024E pre-EVA range 208% upside to midpoint of the 2025E range |

| 42 APPENDIX |

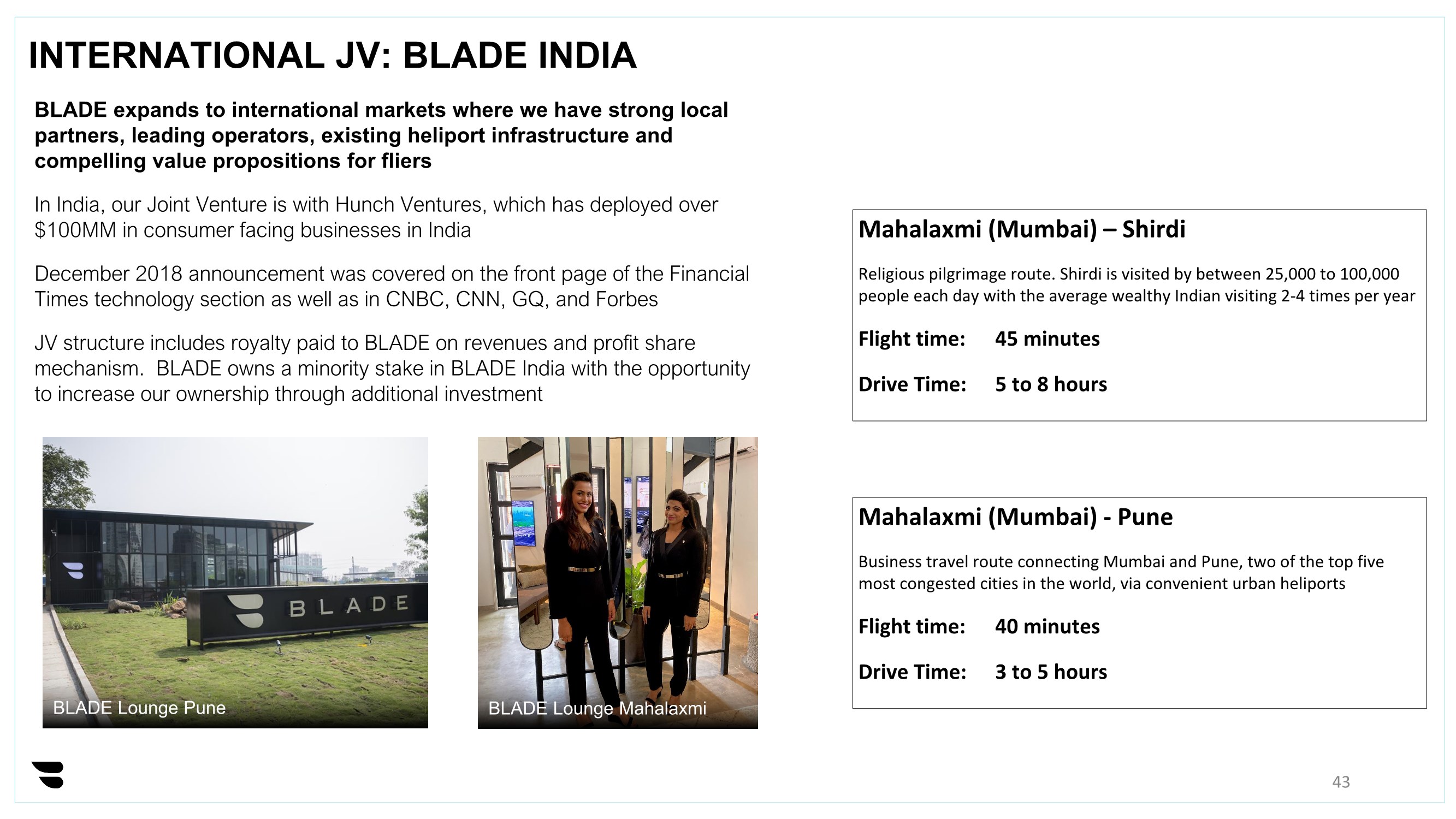

| INTERNATIONAL JV: BLADE INDIA Mahalaxmi (Mumbai) – Shirdi Religious pilgrimage route. Shirdi is visited by between 25,000 to 100,000 people each day with the average wealthy Indian visiting 2-4 times per year Flight time: 45 minutes Drive Time: 5 to 8 hours Mahalaxmi (Mumbai) - Pune Business travel route connecting Mumbai and Pune, two of the top five most congested cities in the world, via convenient urban heliports Flight time: 40 minutes Drive Time: 3 to 5 hours BLADE expands to international markets where we have strong local partners, leading operators, existing heliport infrastructure and compelling value propositions for fliers In India, our Joint Venture is with Hunch Ventures, which has deployed over $100MM in consumer facing businesses in India December 2018 announcement was covered on the front page of the Financial Times technology section as well as in CNBC, CNN, GQ, and Forbes JV structure includes royalty paid to BLADE on revenues and profit share mechanism. BLADE owns a minority stake in BLADE India with the opportunity to increase our ownership through additional investment BLADE Lounge Pune BLADE Lounge Mahalaxmi 43 |

| INDUSTRY LEADING HEALTH AND SAFETY MEASURES Los Angeles New York City • Stringent health protocols exceeding industry norms, designed by BLADE’s Chief Medical Advisor1 • Includes temperature and blood oxygen saturation screening, as well as electrostatic decontamination of all aircraft interiors prior to every flight • Masks and face shields worn by all BLADE staff • Passengers are required to wear masks for the duration of their journey • BLADE offers an end-to-end closed-solution including our “Safe SUV” ground transport and private terminals enabling zero contact with any fliers not on a passenger’s flight (1) Dr. Andrew Bazos is the Designated Medical Director for FEMA in New York City and is the founder of CrowdRx, a provider of medical services for large events. 44 |

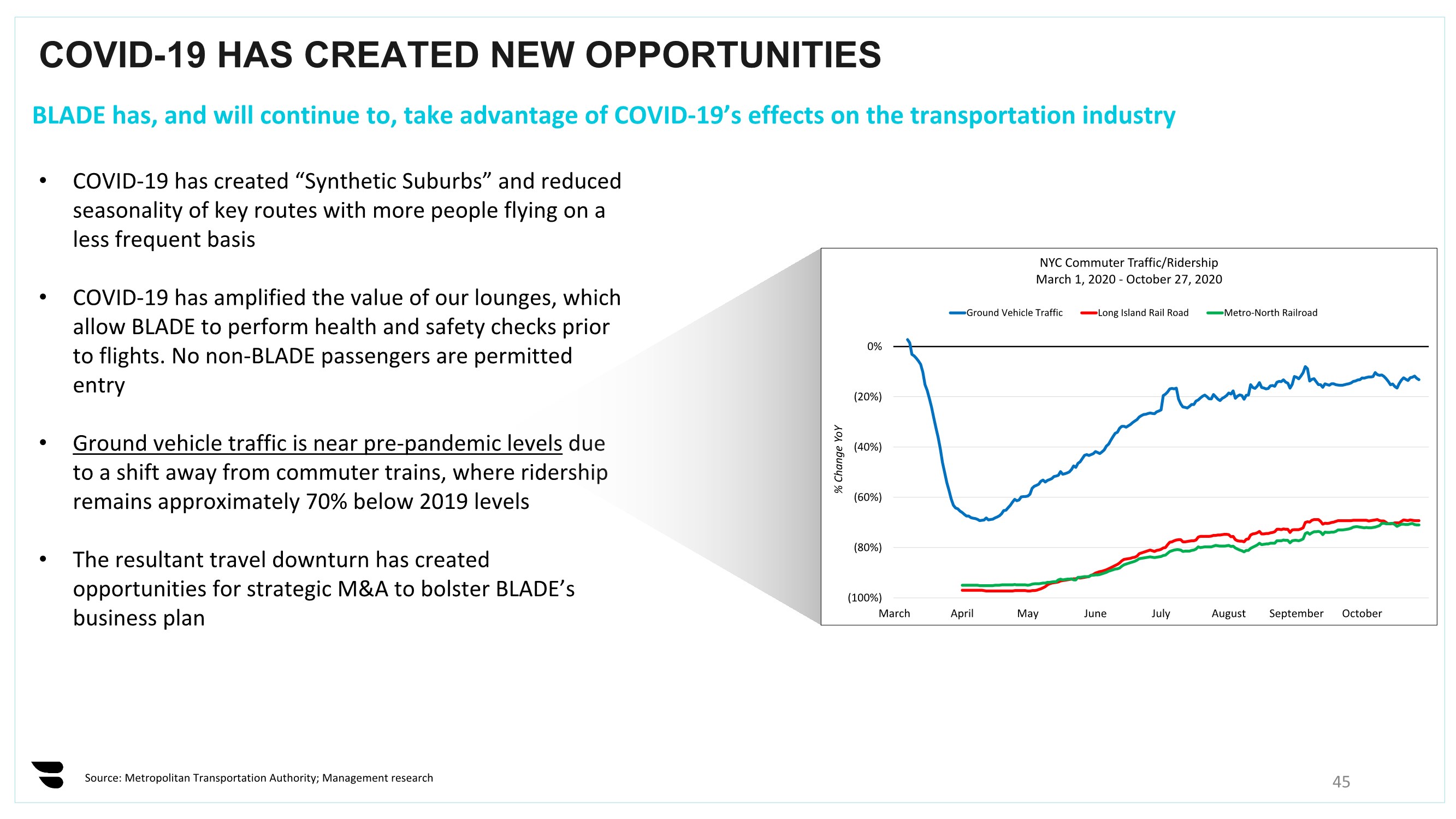

| COVID-19 HAS CREATED NEW OPPORTUNITIESSource: Metropolitan Transportation Authority; Management research BLADE has, and will continue to, take advantage of COVID-19’s effects on the transportation industry • COVID-19 has created “Synthetic Suburbs” and reduced seasonality of key routes with more people flying on a less frequent basis • COVID-19 has amplified the value of our lounges, which allow BLADE to perform health and safety checks prior to flights. No non-BLADE passengers are permitted entry • Ground vehicle traffic is near pre-pandemic levels due to a shift away from commuter trains, where ridership remains approximately 70% below 2019 levels • The resultant travel downturn has created opportunities for strategic M&A to bolster BLADE’s business plan (100%) (80%) (60%) (40%) (20%) 0% March April May June July August September October % Change YoY NYC Commuter Traffic/Ridership March 1, 2020 - October 27, 2020 Ground Vehicle Traffic Long Island Rail Road Metro-North Railroad 45 |

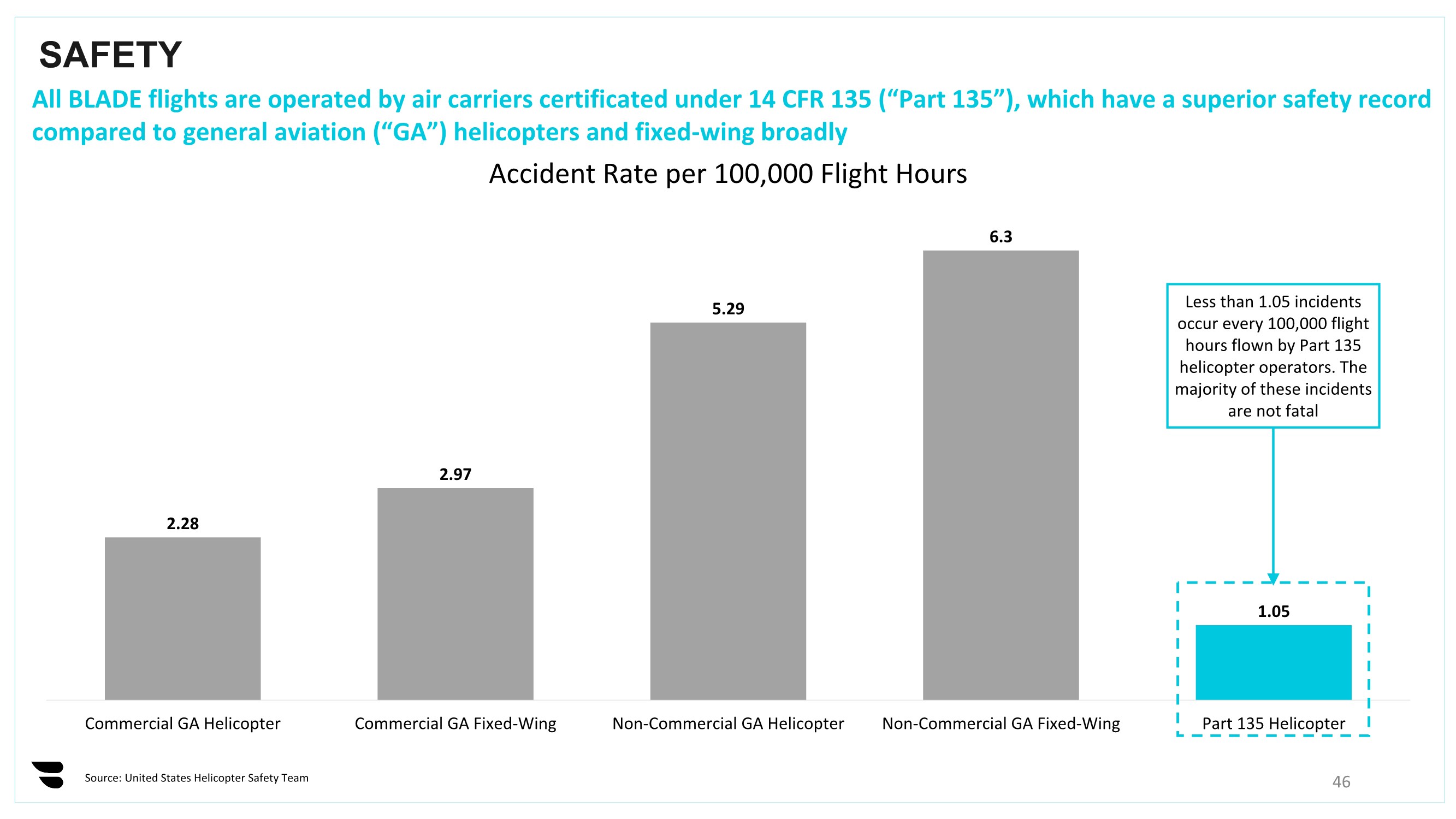

| SAFETY Source: United States Helicopter Safety Team All BLADE flights are operated by air carriers certificated under 14 CFR 135 (“Part 135”), which have a superior safety record compared to general aviation (“GA”) helicopters and fixed-wing broadly 2.28 2.97 5.29 6.3 1.05 Commercial GA Helicopter Commercial GA Fixed-Wing Non-Commercial GA Helicopter Non-Commercial GA Fixed-Wing Part 135 Helicopter Accident Rate per 100,000 Flight Hours Less than 1.05 incidents occur every 100,000 flight hours flown by Part 135 helicopter operators. The majority of these incidents are not fatal 46 |

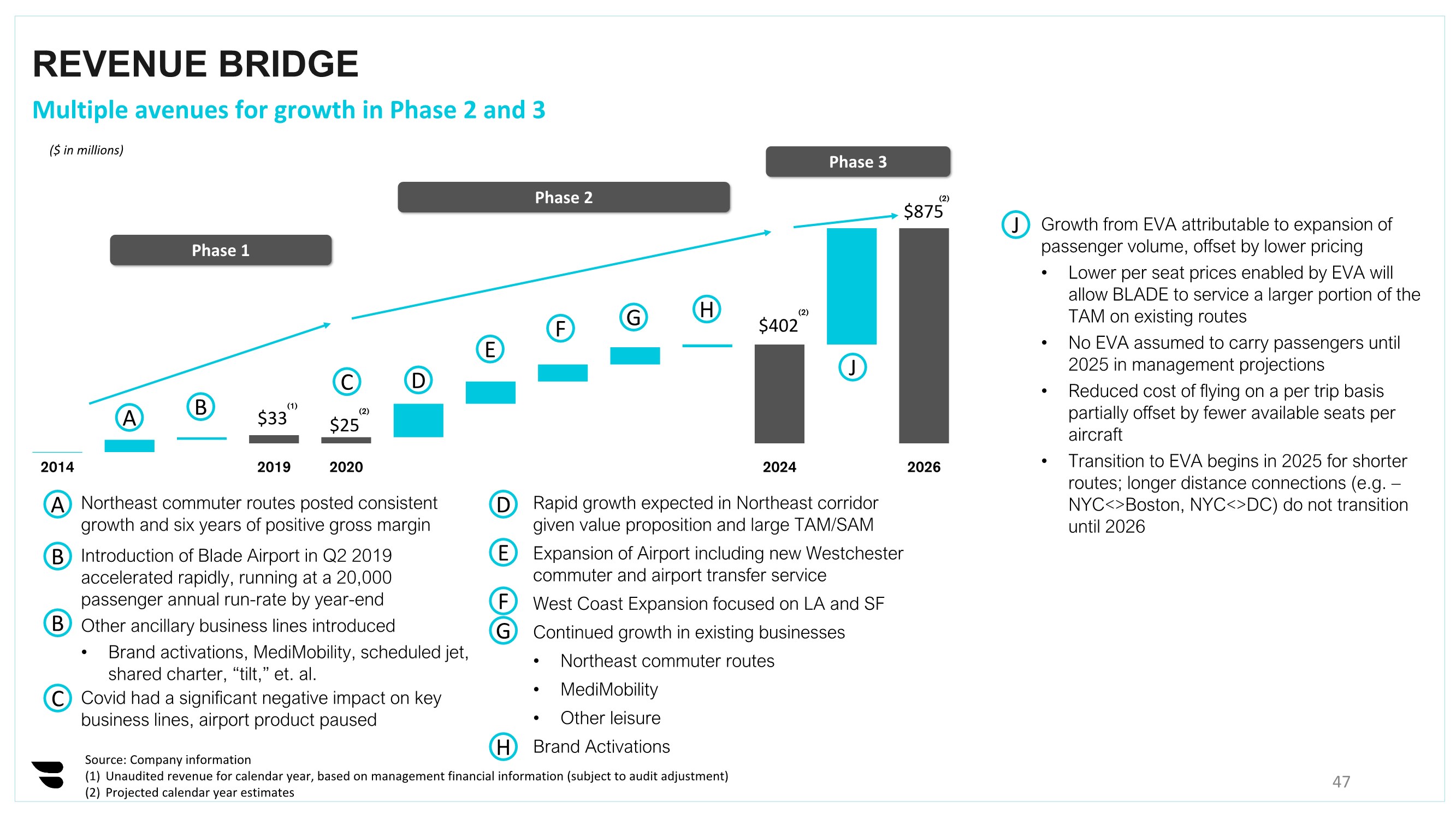

| REVENUE BRIDGE 47 • Northeast commuter routes posted consistent growth and six years of positive gross margin • Introduction of Blade Airport in Q2 2019 accelerated rapidly, running at a 20,000 passenger annual run-rate by year-end • Other ancillary business lines introduced • Brand activations, MediMobility, scheduled jet, shared charter, “tilt,” et. al. • Rapid growth expected in Northeast corridor given value proposition and large TAM/SAM • Expansion of Airport including new Westchester commuter and airport transfer service • West Coast Expansion focused on LA and SF • Continued growth in existing businesses • Northeast commuter routes • MediMobility • Other leisure • Brand Activations • Growth from EVA attributable to expansion of passenger volume, offset by lower pricing • Lower per seat prices enabled by EVA will allow BLADE to service a larger portion of the TAM on existing routes • No EVA assumed to carry passengers until 2025 in management projections • Reduced cost of flying on a per trip basis partially offset by fewer available seats per aircraft • Transition to EVA begins in 2025 for shorter routes; longer distance connections (e.g. – NYC<>Boston, NYC<>DC) do not transition until 2026 A B B D E F H G 2014 2019 2020 2024 2026 (1) (2) (2) (2) Source: Company information (1) Unaudited revenue for calendar year, based on management financial information (subject to audit adjustment) (2) Projected calendar year estimates J AB D E FGH ($ in millions) J Phase 1 Phase 2 Phase 3 C • Covid had a significant negative impact on key business lines, airport product paused C $33 $402 $875 $25 Multiple avenues for growth in Phase 2 and 3 |

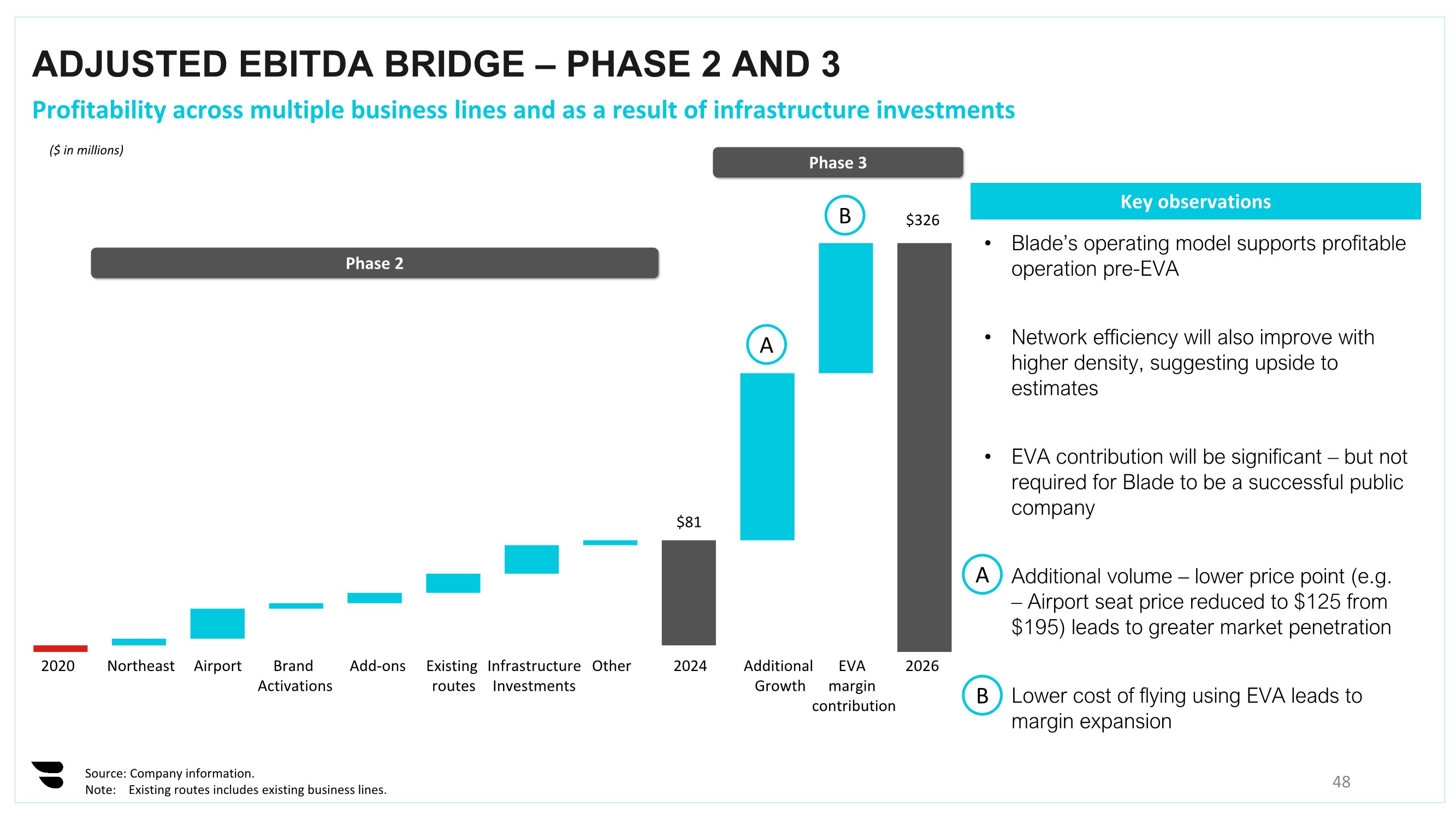

| ADJUSTED EBITDA BRIDGE – PHASE 2 AND 3 48 • Blade’s operating model supports profitable operation pre-EVA • Network efficiency will also improve with higher density, suggesting upside to estimates • EVA contribution will be significant – but not required for Blade to be a successful public company • Additional volume – lower price point (e.g. – Airport seat price reduced to $125 from $195) leads to greater market penetration • Lower cost of flying using EVA leads to margin expansion Source: Company information. Note: Existing routes includes existing business lines. Key observations ($ in millions) Northeast Airport Brand Activations Add-ons Other $81 Additional Growth EVA margin contribution $326 Existing routes 2020 2024 2026 A B A B Infrastructure Investments Profitability across multiple business lines and as a result of infrastructure investments Phase 2 Phase 3 |

| DE-RISKED FINANCIAL PROJECTIONS BLADE’s plan is focused on low-risk expansion of our existing business and primarily utilizes our existing infrastructure Core Northeast Market Expansion BLADE has operated in the Northeast since 2014 and has flown hundreds of thousands of fliers Existing Infrastructure Growth plan is calibrated based on current estimates of infrastructure capacity, in many cases terminal space is exclusive to BLADE Throughput Comparable to Historical Peak BLADE’s infrastructure and systems are designed to handle compacted demand, our projections do not surpass peak historical hourly throughput until 2025 Contracted Unit Economics Profitability based on current unit economics. No reduction in flying cost is assumed, even though increased volume will likely lower hourly rates Existing Technology Platform BLADE’s customer-to-cockpit technology platform has a proven capability to handle large passenger volumes with compacted demand 200,000+ Current Users BLADE benefits from an existing engaged customer base which will speed time-to-market and lower customer acquisition costs 49 |